Integrated planning is a utopia in business circles.

It's often sought, yet rarely found.

Companies that succeed with integrated planning achieve a huge competitive advantage: they make smarter, more informed decisions that are based on data - not on guesswork.

Here's how:

Integrated planning takes in-depth data and models from across your business and stores it in one, central application.

Gartner defines integrated planning and modeling as follows:

"[It] brings together financial planning and operational planning. This area joins the financial planning components of other business domains, such as workforce and sales with those of corporate finance."

Bringing together all of your data not only gives you a single version of the truth but a single version of the "detailed" truth, where both financial and operational models are linked for a complete view of the business.

It helps finance take the lead on budgeting and long-term planning while better supporting sales, marketing, operations and other departments.

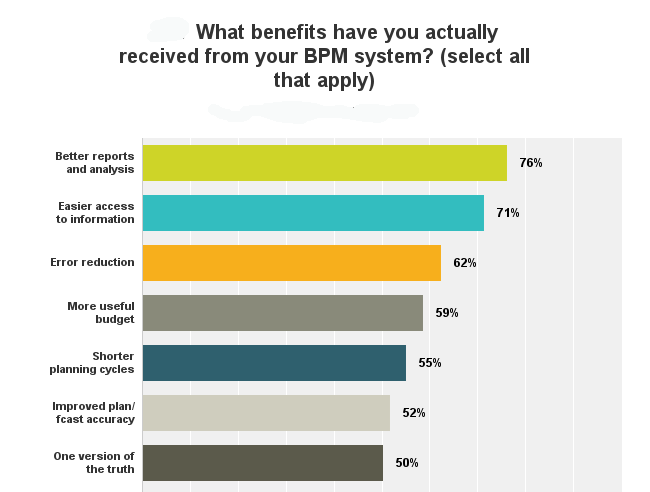

Integrated planning delivers other benefits - from improved reporting to a more useful budget. A 2017 BPM Partners study revealed that companies that improve their financial systems achieve goals ranging from better reports and analysis to shorter planning cycles and error reduction:

With all of these benefits, it's not surprising that integrated planning remains a priority for 40 percent of finance leaders. Gartner also found that by 2020, at least 25 percent of enterprises will increase their planning accuracy by integrating their operational and financial planning efforts.

Although finance leaders recognize the benefits of integrated planning, adoption rates remain low.

So, what's preventing them from updating their systems?

So, what's preventing them from updating their systems?

Many companies lack the right people, processes, and software to achieve results from integrated planning. In fact, just 23 percent of companies are confident in their planning efforts due to out-dated tools and processes.

Let's take a closer look at why these three areas are critical to integrated planning:

Employees create their own systems and processes as they encounter new business challenges. Once they have a system that they like, they don't want to change it. For example, they may have Excel models that work for them and don't want to learn how to use new financial software and recreate their logic.

Departments also have their own ERP and data warehousing systems, and bringing all of them together can get complicated - quickly. You need technology to integrate your data.

If you still rely on old, legacy technologies, you may be looking at significant change management and IT investment to succeed with integrated planning. If you don't achieve high adoption rates and fast time-to-value, employees will lose interest and go back to their old ways of doing things.

Problems with your people and processes are closely related. For example, employees may resist making any changes to their long-standing workflows. Getting people to change their methods is the biggest roadblock to integrated planning.

Integrated planning also requires a massive data collection effort. Your analysts, managers, directors, and business end-users are all involved in the submission and collection of data from each department. Not only must you get these people on board, but also connect the data from their disparate sources.

Traditional finance software makes integrated planning a painful process. It lacks critical features, such as the ability to integrate data from multiple departments.

Also, many programs are designed for finance professionals or "power users" and are neither accessible nor intuitive for business users. Employees who don't have a financial background may have a hard time viewing, reporting on, or analyzing data.

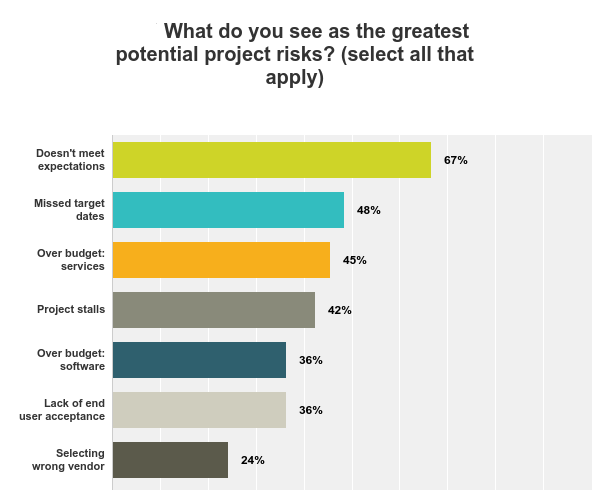

The risks of integrated planning are similar to those of broader systems, such as corporate performance management (CPM). Research from BPM Partners highlights the main reasons - including missed target dates, expectations and project budgets - why these projects fail to get off the ground:

Because of these concerns, it's often hard to get buy-in from finance leaders, other C-suite members, and employees.

The right systems can help you achieve the utopia state of integrated planning.

Look for a solution that allows you to overcome your people, process, and software roadblocks. The right technology can address all of these challenges by:

Your technology should make it easy for both finance and business users to access in-depth data from across your company. When you can show others the benefits of aligned planning, you'll have a much easier time getting buy-in from both executives and end-users. You will also raise awareness of your finance team as your planning leader.

Here are three essential features to look for in your integrated planning solution:

Most companies store their data in silos across their business. If you want to run a report on data from outside of finance, you probably need to take a number of manual, repetitive steps: logging into the correct system, finding the report, downloading it to an Excel file, reviewing and editing it, then forwarding it to the appropriate team members.

Multiply these steps by the number of reports that you run in any given week, let alone those that span data from multiple departments, and your time quickly adds up.

According to the Cognizant Center for the Future of Work, employees spend 22% of their time on repetitive tasks. Anyone in finance or accounting knows, for some roles, this figure can be two to three times higher.

Look for a system that makes it easy for you to bring all of your company's data and processes together, so you can:

Most finance planning tools only give you a high-level summary of numbers from other departments. This forces you to take extra pains to fill in the gaps - or make decisions based on incomplete data.

Look for an integrated planning system that puts in-depth financial and operational data and models from across your company into one central database. This allows you to:

Your system should also bring in your actuals when you close the month. That way, you can quickly identify your variances and the factors behind them, and most importantly - act on them.

With so many disparate spreadsheets and departmental systems in place, it's not easy to browse through different data models to do the analysis you need to drive better decisions. That's because most data modeling tools are designed for IT professionals or consultants - not for the business end-users who need reports for their day-to-day jobs.

With so many disparate spreadsheets and departmental systems in place, it's not easy to browse through different data models to do the analysis you need to drive better decisions. That's because most data modeling tools are designed for IT professionals or consultants - not for the business end-users who need reports for their day-to-day jobs.

Look for a system built for end-users. It should help you easily:

Our Chief Financial Officer, Darrell Cox, recently shared a story on how integrated planning helped him meet his sales targets at a previous job.

Darrell was working for a telecommunications company and struggled with maximizing sales during the holiday shopping season. To meet his targets, he needed to match devices with the retailers who would sell them best.

"We could have phones in a thousand retail outlets, but if we didn't have the right phones in the right locations at the right time, we would lose sales before Christmas. And after Christmas, we'd have an ugly inventory write-off," said Darrell.

Darrell didn't want some outlets to sell out of phones while others ended up with overstock.

So, Darrell and his team built a data warehouse to collect financial and billing system information. Then retail outlets uploaded data about their stock and sales. The head office could assess the inventory and take proactive steps get the phones where they were needed most. For example, they couriered devices between stores to ensure that supply met demand.

According to Darrell, the integrated planning resulted in, "a significantly lower inventory write-off, a happier retail distribution channel, and more happy customers."

Integrated planning offers companies a number of benefits. According to Gartner, it helps you achieve the following:

With the right technology, these benefits are absolutely attainable.

Discover how you can streamline and integrate your planning to make smarter, more informed decisions. Try Vena today.

Evan Webster is an experienced sales professional and storyteller with a passion for innovative technology. He currently serves as a Senior Area Sales Manager at Vena and previously worked as a Content Specialist. He continually strives to inspire finance professionals to become strategic business partners and is dedicated to helping them automate and streamline their planning processes so they can make better decisions with reliable, data-driven insights—enabling meaningful growth for organizations across the globe.