Home

Financial Planning & Analysis Software

The Only Native Excel FP&A Software

Central Database

Vena’s powerful cloud database integrates with your source systems and aggregates your data.

Excel Templates

Our solution includes templates that contain embedded logic to plan for sales, COGS, and operating expenses.

Workflows

Leverage the workflow to distribute templates by entities/departments, control the submission and review processes.

Accurately Plan for Your Financial Future

Vena Foundation for FP&A is a pre-configured yet customizable solution that includes the integrations, data models, reports, templates and data analysis tools to support your financial planning and analysis needs.

Budgeting

Reduce your budget cycle times and create budgets based on any requirement: top-down, bottom-up, zero-based or driver-based.

Forecasting

Plan for the future with confidence using integrated financial statements, rolling forecasts, what-if analysis, unlimited modelling capabilities and more.

Financial and Businesswide Reporting and Analysis

Compare financials between departments, build ad hoc reports and get a granular view of your income statement. Plus leverage your data in Vena Insights to unlock powerful strategic insights and self-service analytics.

Variance Reporting and Analysis

Vena automatically rolls actuals from your source systems into your budgeting templates so you can produce your variance reports in no time at all.

Get Back Lost Time With Powerful Financial Planning and Analysis Tools

FP&A tools like our workflow builder help you simplify your processes and automate tasks so you have more time to collaborate with your team and focus on analysis.

Turn Excel Into a Complete FP&A Platform

Vena uses the interface you know and love—Excel—and adds powerful functionalities such as template and version control, drill-throughs, quick build reports and more.

Keep Your Data and Templates Safe

Our financial planning and analysis tools give you the ability to control access and manage permissions down to the individual user level for your templates, data and inputs.

Find the Story Behind Your Numbers With Audit Trails

Improve accountability with audit trails that allow you to see the history of each cell and number. And compare different versions of a template with just one-click and see spot the differences with highlights.

Growing Further With Add-Ons and FP&A Tools

Vena’s financial planning and analysis software has available add-ons for Workforce Planning, Capital Planning, Agile Planning and more.

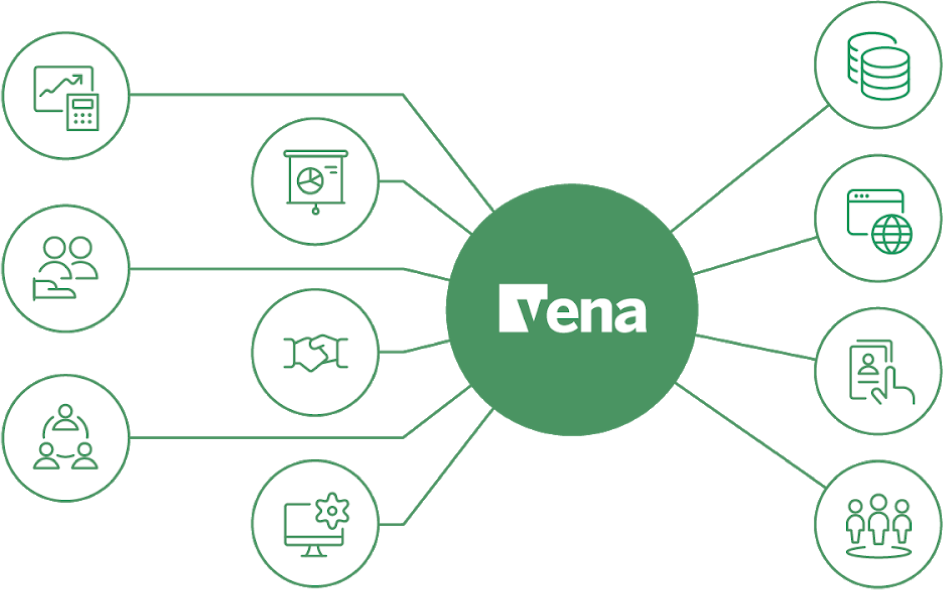

Integrate Your Data With Vena’s Financial Planning and Analysis Software

Integrate all your business’ data sources—financial, non-financial, internal and external—so you can plan with trustworthy numbers and say goodbye to copying and pasting data into your templates.

ERP and GL Integration

Integrate general ledger data from ERPs such as Sage Intacct, NetSuite, Microsoft Dynamics, Quickbooks, Sage Intacct and FinancialForce into your templates so you can be sure you’re always working with accurate, up-to-date numbers.

HRIS Integration

With our financial planning and analysis software, you can load data from HRIS systems such as ADP, Workday, Bamboo and more.

Import Your Excel, CSV, Flat Files into Vena’s FP&A Solution

Bring your existing Excel spreadsheets and templates into Vena to take advantage of our advanced modelling capabilities, audit trails, drill-down functionality and more.

Homegrown Systems and Databases

Load data from homegrown systems, SQL databases and data warehouses into Vena’s cloud database.

Reports and Templates Built for FP&A

Vena’s FP&A software includes secure and centrally controlled templates and reports that are built with best practices in mind and designed to get you up and running quickly.

- Corporate Financial Statements: Balance Sheet and Income Statement

- Income Statement Reports: Departmental, Variance and Detailed views

- Revenue Planning Template

- Operating Expense Planning Template

- Balance Sheet Template

- Cash Flow Planning Template

%201.jpg?width=794&height=444&name=Financial%20Statements%20PL%20(1)%201.jpg)

Lookout “Doesn’t Have To Scramble Anymore” Thanks to 66% Faster Reporting With Vena

“Vena really resonated with me as a finance professional right from the start—because any modeling I can do in Excel, I can do even better and faster in Vena.” - Ricardo Trigueros, Sr. Financial Analyst at Lookout

Business Value Calculator

Calculate your annual estimated benefits of using the Vena Platform

Get Started With Vena Today

Learn how Vena can help your organization Plan for Anything.

_Leader_Leader%20(1).png?width=770&height=1000&name=CorporatePerformanceManagement(CPM)_Leader_Leader%20(1).png)

_BestUsability_Enterprise_Total.png?width=770&height=1000&name=CorporatePerformanceManagement(CPM)_BestUsability_Enterprise_Total.png)