Real estate developers have a daunting task: taking a piece of land and turning it into something else—whether it be a rental property or a condo, a low-rise housing project or a commercial site.

Like other businesses, they want the project to make money. But unlike many other companies, those profits will likely take years to realize, as they plan out, design, then build the project in question.

So how do you know the project you’re setting out to develop will be profitable in the end?

For real estate developers, evaluating and maximizing construction profitability means keeping track of ongoing costs—over years and sometimes across multiple projects—and responding with agility to change to ensure they see their expected return on investment (ROI).

So what exactly do you need to know to do that? We break it all down in this blog.

Key Takeaways

- To evaluate a project’s potential profitability, developers need to build a construction budget that considers both hard and soft costs and compare them to projected returns.

- Sometimes a project will be deemed infeasible from the start, but even when a project goes forward, developers can’t stop evaluating and maximizing its profitability—keeping up with shifts in the market, as well as unexpected costs and timeline delays.

- There are several key metrics developers can track to stay abreast of change—but without the right planning tool, these can be challenging to keep up with.

Evaluating the Profitability of Your New Project

Before you can do anything, you must assess the profitability of a given property—or even whether it has the potential to be profitable at all. This will help you determine whether a property makes sense for development and, if it does, what type of project you should build.

For a property to be feasible, it needs to be able to earn a healthy return on investment once everything is paid out. That means, of course, that anticipated profits need to exceed expected costs.

Specifically, as you create your construction budget, you’ll need to consider two types of costs—each of which can affect your profit margins:

- Hard costs: Hard costs are your construction costs. They include labor, subcontractors (for instance, electricians and plumbers), land costs and the costs of all of your building materials.

- Soft costs: Soft costs are everything that isn’t specifically related to construction. They include architectural and engineering services, interior and landscape design, site analysis, marketing, legal fees, financing and administrative costs.

But while nailing down the initial budget is the first step to a profitable project, maximizing profitability doesn’t end there. Once you decide to move ahead with a project, you’ll need to keep track of a range of market variables to ensure your development’s return on investment remains intact.

“The overall economic condition is going to be changing throughout the life of the project,” said Kyli Lane, chartered accountant and Solutions Consultant for Vena. “That’s something that developers are going to need to have a pulse on.”

Keeping Up With Change

The real estate market is always changing. That means even once your project proceeds, you’ll be faced with decisions and setbacks at every turn.

From hold-ups getting permits or funding, to supply chain issues or labor shortages, those challenges can lead to significant delays. And every delay can potentially impact your construction budget, affecting your project ROI. Fluctuations when it comes to interest rates, inflation, market prices or ultimate demand for the units you’re building can also have an impact.

To maintain and maximize construction profitability, as a developer you must assess all those variables on a regular basis to ensure you’re on track to earn your projected return on investment.

“There are various factors companies need to have a pulse on every month, every quarter—reporting to their investors to see ultimately what that anticipated return is going to be,” said Kyli, who prior to joining Vena worked on the finance team of a condominium development firm.

For instance, you'll want to watch:

- How the market is changing in your community and how that affects sales and rental prices, as well as demand.

- How inflation and interest rates are fluctuating and how that will impact borrowing rates, as well as the ultimate prices/rents you’re able to command.

- Overall economic conditions, which can impact how much renters/buyers are able to pay and whether they want to make a move at all.

As conditions change and/or you incur new, unexpected costs, you may need to raise your prices or projected rents to ensure profitability down the line. But sometimes the market won’t allow for that.

“When projected cost surpasses market value, it becomes imperative for companies to thoroughly assess the building to recoup those costs,” said Louis Lomax, Founder and CEO of Vena partner Ujimatec, which works with construction companies to help them maximize profits.

That means you might have to find ways to cut the budget—perhaps by identifying new efficiencies or by looking for ways to cut back on your final vision.

“What happens is developers will partner with an architect and they’ll dream up the design—they may have these amazing ideas,” Kylie added. “But then they do a budget, and it’s not as robust as it could be. And then, corners are cut.”

5 Metrics That Can Help Maximize Profitability

Developers employ several metrics to measure return on investment during the course of a project:

Net Present Value

Net present value (NPV) measures the difference between the present value of your cash inflows and outflows over a specified period of time. It’s a way of determining the net profit or loss a project will generate based on today’s market conditions and can be used to assess the viability of a site.

Net Operating Income

Your net operating income (NOI) is the annual income your property promises to generate after deducting your operating expenses—including taxes, utilities, maintenance and insurance, but not including debt service, capital expenditures or depreciation.

By estimating your property’s potential income and vacancy rate, along with operating expenses, you can determine potential construction profitability and compare your current project to others to see how it measures up.

Internal Rate of Return

The internal rate of return (IRR) looks at the annualized rate of return on your project investment. It’s a way of determining the construction project ROI, whether it makes sense to proceed with a project and the efficiency of a development site throughout its lifecycle—with a higher IRR showing a higher return.

But, risk is also a factor. If a high IRR comes with higher risk—through increased equity financing, for instance, which can be more expensive than traditional debt and reduce profits for developers—the project may still not be worth pursuing.

Capitalization Rate

Your capitalization rate (cap rate) is the ratio between your NOI and the property’s value or purchase price. It’s a way of measuring the rate of return on your investment.

The higher the cap rate, the higher the return—but again, with an eye to risk. Your cap rate can help you estimate the market value of your property or compare the value of your property to others on the market.

Profitability Index

Finally, the profitability index (PI) measures a property’s potential for profit—helping developers determine whether a project makes sense from the start.

By measuring the ratio of the present value of future cash flows against the initial investment, it allows developers to rank potential projects and shows the value per unit of investment. A PI greater than one is a sign that the project has the potential to generate profit and may be worth going forward with.

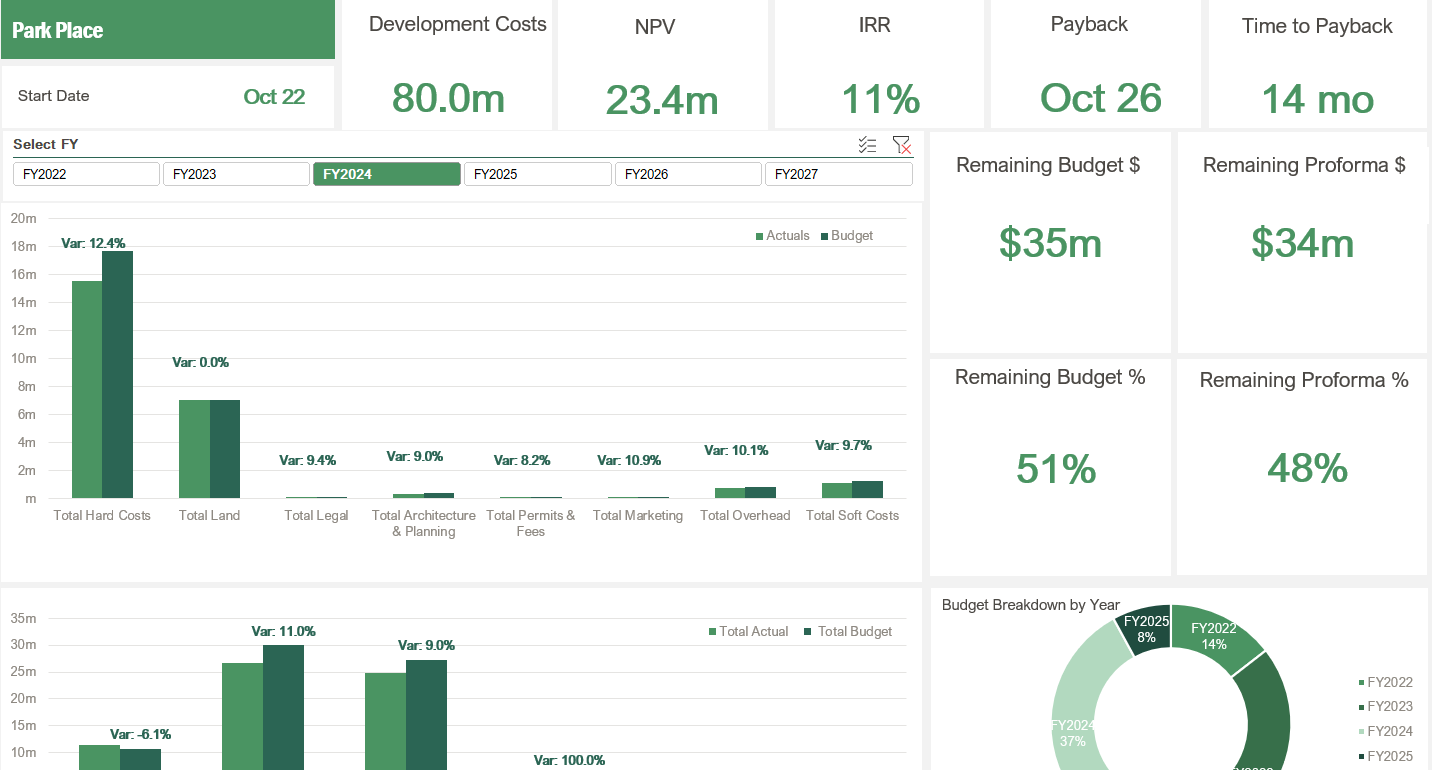

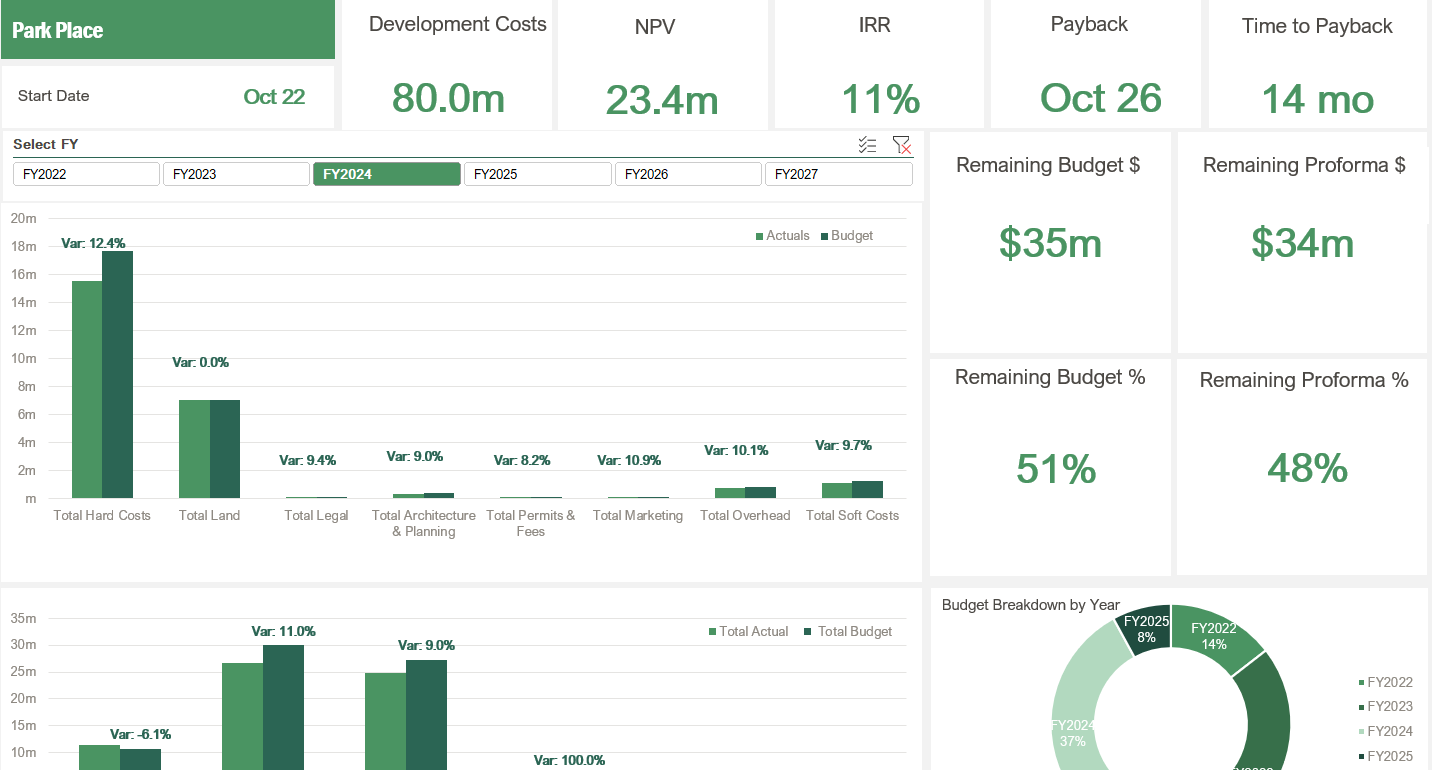

Creating a dashboard like the one below to track of all your critical metrics can help you understand your project’s profitability potential on an ongoing basis. That way you know when you need to make changes to your plans to maintain and maximize your development’s ROI.

A view of a property development reporting template available in Vena.

Maximizing Your Return on Investment

To understand whether costs need to be cut or prices raised—or whether you’re able to continue on your current path—a few processes will become vital.

As your finance team evaluates ongoing costs to maximize return on investment, you’ll want to pay special attention to:

Cash-Flow Planning

“Cash-flow planning is key,” Louis said, for real estate developers as they navigate through the development cycle. It significantly influences construction profitability planning from inception to completion, focusing on understanding the costs at every project stage to maintain healthy profit margins.

“In the context of model-based construction, developers require the capability to aggregate costs for each model according to the assigned number of units based on the project schedule,” Louis added.

“This enables the projection of costs for each period, facilitating the process of requesting draws from banks or other lenders. Tallying up unit sales against the cost schedule also provides developers with a clear picture of the building’s overall profitability.”

Scenario Analysis

Scenario analysis can help developers determine whether a project even gets off the ground. If you do go ahead with a project, conducting a scenario analysis will allow you to anticipate change and continue making smart decisions at every step throughout a multi-year development project.

For instance, you may choose to analyze for:

- Assumptions around the cost of debt and interest rates, and how they’ll affect the cost of borrowing.

- Assumptions about what your units will be able to sell or rent for. Prices can vary depending on your location, particularly in the fastest-growing cities where strong demand can drive up both sale prices and rental rates.

- Assumptions, in the case of rental projects, on how rents will grow and continue to add to construction profitability scenarios.

“The ability to perform scenario analysis across macro and micro assumptions will ultimately impact what the rate of return is going to be on the development,” Kyli added.

Cost Projection

Cost projection is a tool that allows developers to plan out their costs, estimating future expenses based on market conditions and more—then putting those budgets into action. It also lets you monitor the project’s costs along the way, to ensure you’re staying on budget.

“Contractors, project managers and/or foremen walk around their job site, going into each room/unit determining a real ‘percent complete’.” Louis explained.

“The percentage of completion can be determined through various methods, such as a flat percentage, production quantities, or the quantity to complete. Analyzing this projection in conjunction with the project budget yields valuable insights into the project's performance trends, pinpointing areas of success or setbacks.”

Consider, for instance, a scenario where a project is halfway completed, with $1 million spent and a remaining cost to complete of $1 million. This results in a total projected cost of $2 million at completion.

“Conducting this analysis on a monthly basis streamlines both the project's billing cycle and cash flow,” Louis explained, “offering valuable insights into whether the project requires reevaluation or needs a change order to safeguard its profitability.”

The Challenges of Measuring and Maintaining Construction Profitability

But keeping up with the ongoing financial demands of a development today—as markets change, costs rise and you try to remain profitable, often across multiple projects—isn’t necessarily easy.

Tracking costs and continually modeling for the future has traditionally been a complex endeavor for finance teams within real estate firms. Without the right planning tool in place, multiple challenges can get in teams’ way:

1. It’s Time Consuming

Without the right technology stack, constantly modeling for different scenarios and plugging in new data as those scenarios change can be time consuming and laborious. And that makes it difficult for teams to stay agile in the face of market changes.

Take Kyli’s past position at a development firm for instance.

“I wasn’t really even scenario modeling. I just had this massive workbook that I would play around with,” she said. “But then we were losing all of our previous versions. There were a thousand versions of something saved on a server, and the CFO would be like ‘Oh my God, which one do I look at?’”

2. It’s Hard To Stay Agile

Construction budgets and the models that support them can quickly get out of date when managed solely in Excel, as new costs are added and market changes occur. This again makes it difficult for your team to stay agile and make the up-to-the-minute decisions your line of work requires.

“I took a day to dump in data on a Wednesday morning, to track our costs to date. I’d use that for a presentation to my CFO to say this is how we’re tracking,” Kyli remembered. “But then somebody goes and books a $500,000 expense later that night and now I don’t have that up to date for my presentation.”

3. You Risk Human Error

Finally, taking on all that data manipulation manually can also create more chance for human error.

“There’s a lack of accuracy and risk of manual error in terms of being able to track actual spending to date, as well as less visibility into ultimately what your cost of the project is at any given point in time,” Kyli said.

How a Complete Planning Solution Can Help

A complete planning solution like Vena can help your real estate development team get past these obstacles while maximizing your project ROI.

It empowers you to simplify your budgeting and cash-flow planning and automatically integrates data from your source systems into a single, central data model so you can stay on top of the most current costs to date.

We’ve made it easy to plug that data into multiple what-if scenarios, so you can also analyze for every possible future.

“That really brings value. You can run those different scenarios,” said Kyli, who brought on Vena at her previous job, before joining the Vena team herself.

“Vena was really valuable to us from a modeling perspective, because otherwise everything’s just manual and you’re constantly spinning your wheels trying to pull this data and run these manual models. Vena allows you to just be more nimble with your evaluations and in your modeling.”

For developers, this also means assessing construction profitability across multiple projects that may be going on at the same time, planning cash flow and better understanding and comparing the costs on each.

“We can consolidate all the data for every single company and combine it on one page,” said Louis, who employs Vena in the work he does with his clients. “[And] they're able to perform cost tracking at the unit level, a crucial capability that allows them to assess profitability on a per-unit basis.”

With Vena for real estate, you also get access to pre-built (yet customizable) planning templates, reports and dashboards such as:

- Development Evaluation Template

- Preconfigured Property Development Construction Budget

- Property Development Forecast Template

- Variance Report

- Vena Insights Dashboard

Start Maximizing Your Construction Profitability Today

Real estate developments are multi-year investments—meaning it will be years before you realize a full return on investment. A lot can happen during that time—from market changes and unexpected costs to interest rate adjustments and shifts in demand.

If developers don’t have a way of keeping up with all that ongoing information, they risk eating into their profit margins before the project is even complete.

To maximize profitability, you need processes that will let you stay up to date with the latest market changes and continue looking forward—and a tool that will empower you to stay on top of those goals.

A complete planning solution like Vena can help you do exactly that.