Mastering the financial close process is essential for any well-run organisation. The first step in doing the important work in FP&A is consolidating your firm's data and reconciling your accounts. But your organisation's size and the complexity of its structure will influence how difficult that process is.

Many finance professionals find themselves crunched for time trying to complete their close reporting and deliver insights to the C-suite and other decision makers. One solution to the challenge of time is how you use financial close software.

Whether you're looking to automate your manual systems or are unhappy with your current software, we've compiled the most important aspects to consider when choosing a financial close management software solution that's right for you.

important to understand the general goals you're hoping to achieve from it. Keeping these goals in mind will help you evaluate a solution's potential benefits. For most finance professionals, the financial close process is about refining two constant challenges--the speed and accuracy of your reporting.

Quickly compiling and generating your financial close reporting is essential for responding to changes in your business in real time and making better strategic decisions. Manual financial close processes often take longer because you must rely on team members to provide data and input figures through traditional methods. This creates latency between when the financial data is most representative of the organisation's status and when executives or other personnel are analyzing that data to develop a strategy. Your financial close software should provide tools and features that effectively minimise the latency because of the time it takes to close on a monthly, quarterly or annual basis.

Equally important to the speed of your close process is the accuracy of the financial reporting you generate. Getting information faster is of little value if it's filled with errors that prevent your team from making informed decisions. As a result, your financial close management software should contain features that will protect the accuracy of your reporting and decrease the potential for error compared to other solutions.

Now, let's turn our attention to some of the things your financial close software should do that will improve the speed and accuracy of your financial close process.

Having disconnected data is a challenge for most businesses, even outside the realm of completing your financial close. Whether your company has a single ERP or uses several different platforms, your financial close software should integrate with them. ithout that integration, you'll still have to rely on manual processes (e.g., email or uploads into unorganised data rooms) to retrieve financial and operational data. What's more, you might find yourself searching again for new software or considering an overhaul to your other source systems after choosing financial close software that does not integrate well with them.

Overhauling systems brings up another important integration concern: support for Excel spreadsheets. Many businesses still rely heavily on Excel for recording transaction data. Your financial close software should respect this reality instead of forcing you to learn a new spreadsheet program.

While having a solution that integrates with your data management systems can save you time retrieving data, automating the close process will take things to another level. The difference between integration and automation is putting your financial data into a form that more closely resembles the finished result of your financial close reporting. Of course, some parts of the close process may always require a degree of manual input. However, the more your close software can effectively automate various tasks, the faster you can do quality control checks and submit reporting for future analysis.

Source: Morgan Franklin

Much of the financial close process is about communicating with all the individuals and groups contributing to the creation of your reporting. CFOs and finance managers are often responsible for managing the workflow between groups. Some of these tasks include:

Hopefully, your financial close management software will make it easier to collaborate on these items and more. The benefit is quickly identifying bottlenecks in the close process and resolving them with minimal interruption to related tasks.

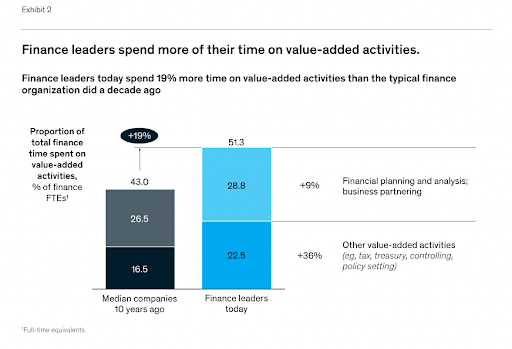

Source: McKinsey

Your financial close software should greatly reduce errors in your reporting and protect the integrity of your data in case of an audit or other compliance review. Features such as version controls, system alerts, variance analysis and tax assistance can secure your data's authenticity by highlighting oddities, pinpointing errors and recovering prior versions when issues arise so you don't have to start from scratch.

Finally, ask yourself if the solution you are considering will improve the uniformity and standardization of your financial close process. Using templates and other programs that create consistency in your reporting from month to month or quarter to quarter will promote the resiliency of your process. Without standardization in your system, you may risk institutional knowledge being lost if key employees were to retire, change jobs or otherwise leave their positions.

Vena's Financial Close Management Software is an end-to-end system built with the goals of speed and accuracy in mind. We want to save you time and allow you to close with confidence, so you can focus more attention on your organisation's growth strategy.

Some key features of our software include:

Vena Complete Planning is meant for all industries. However, we also offer tailored pre-configured solutions for SaaS, Banking, Insurance, Higher Education, Professional Sports, Healthcare and many others. Transform how your company does its financial close process and see the benefits in your forecasting, analysis and other strategic endeavors.