Is your business efficient at generating profits? Is performance improving or getting worse? How can you tell? Profitability analysis.

While the C-suite might focus on net profit margins, as finance professionals, we understand that profitability analysis is more than a barometer of an organisation's performance.

It influences decision making and drives future profits when done correctly. How can you be sure that your profitability analysis processes are efficient and accurate?

Inefficient data processes cost U.S.-based businesses billions each year, and poor data quality costs companies $3.1 trillion each year. Improve your organisation's profitability analysis and data collection processes so your company doesn't become a statistic.

Most organisations will often only focus on revenue growth when developing sales objectives (setting quotas or measuring performance, for example). However, not all revenue is created equal.

When competitive landscapes shift, consumer demands change. As your organisation seizes new opportunities, using profitability analysis could help decipher specific results and deliver insights to the C-suite.

Instead of depending on a bird's-eye view, or worse yet, a gut intuition, of the company's financials, C-suite executives and managers can get fact-based answers about the profitability of each specific buyer, customer group, product, market and service line.

FP&A forums are teeming with finance professionals complaining about how time-intensive profitability analysis is and how challenging it is to compile accurate data. If you attempt to perform data-rich calculations with Excel spreadsheets alone, you won't be able to process your profitability analysis accurately.

You first need a foundation for data for your sophisticated operations. That requires exchanging manual data entry processes and the time associated with these tasks for a comprehensive digital solution to create a single source of truth (SSOT).

According to PwC's 2021 Finance Effectiveness Benchmarking Study, when you harness the power of technology-based central repositories to collect and store data, finance professionals can spend 20% more time on analysis and less time gathering and validating data.

Bottom line, if you are not using a comprehensive, yet simple-to-use financial analytics tool to track metrics to improve profit margins, setting that system in place is step one.

Healthy profit margins depend on various internal and external factors. Benchmarking current profits allows you to ensure performance is consistently improving proactively by capturing profitability ratios.

Internally, you will need to compare segments and profit margins to past periods within the company. Externally, you can assess average margins and ratios in your industry. Elements of an organisation's profit margin ratio include:

Obtaining accurate benchmarks shouldn't require days of digging, either. s A benchmarking tool that uses CapEx software allows you to target key insights from specific datasets for improved analysis.

Not every newly closed deal is a win to celebrate. Known as customer profitability analysis, finance professionals can evaluate the true value of a new customer and how profitable each "win" actually is to the organisation.

Assess marketing strategies, cross-channel engagement, time spent on closing and the entire customer journey to gain these insights.

However, you cannot gain these insights by studying expense and income statements or attempting to apportion operating and other fixed costs. It takes profitability analysis and the willingness to dig deeper to see how changes can strategically drive cumulative profits.

How often your team performs profitability analysis depends on several factors, including industry type, the scope of the report and the period of the assessment. Most organisations conduct annual analyses.

However, while challenging, some metrics require more frequent review. A profitability analysis tool will help streamline this process to simplify the assessment process.

In June 2021, we conducted the Vena 2021 Benchmark Survey and published the results of our findings. We spoke to 175 finance professionals, operations specialists, and business executives from organisations around the world.

While 39% recognised the need for companies to embrace automation, 33% argued disconnected data and over 25% stated that insufficient technology makes embracing these advancements risky.

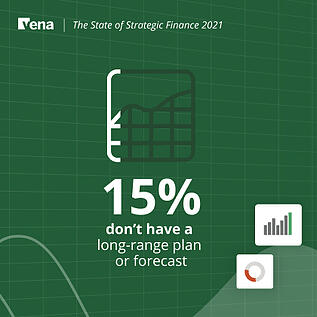

Furthermore, integration might create issues with the company's IT infrastructure, causing the IT department to delay adoption. As a result, some finance and operating teams continue to fall behind in long-range planning and forecasting, and 15% have no strategy whatsoever.

From the beginning, one primary purpose an organisation strives for is to make profits. It's arguably the most critical factor in successful commerce.

Understanding profitability requires an innovative finance reporting tool that harnesses the power of Excel, taking data from on-premise data centers and cloud-based servers and securely storing it in one central repository. Get all the data you need from one place for more accurate reporting. Connect finance with sales more effectively by applying financial metrics to support a more strategic sales planning process.