A 2020 Innovation in Retail Banking report found that banking organizations rated themselves lower in innovation and digital transformation maturity compared to 2019.

The report brought up the question of whether or not legacy financial institutions can avoid "reverting to outdated policies and risk-averse culture," which are factors that have historically held banks back from adopting innovation and digital transformation.

While digital transformation efforts are lengthy and costly endeavors for banks to undertake, choosing not to implement them at all can pose a greater risk.

As interest rates have become increasingly volatile, banks and credit unions need to make timely, data-driven decisions to respond to rapidly changing market conditions. And without modern technology that can automate the time-consuming manual processes of their financial planning functions, this is exceptionally hard to do.

Read on to discover five ways banks and credit unions can uniquely benefit from FP&A automation.

To manage tasks like the budgeting process, most banks turn to Excel. While it’s a tool that likely every department is familiar with and therefore most comfortable using, it’s not equipped to handle all the complexities of running a financial institution.

Here are five ways banks and credit unions can lean on automation to bolster their FP&A processes:

Banks and credit unions collect diverse, extensive volumes of data—between their ERP or GL, Asset Liability Management (ALM), Funds Transfer Pricing (FTP) and Human Resources Information System (HRIS).

When data from these sources have to be pulled manually, this makes it difficult for banks’ finance teams to find the numbers they need, consolidate them and analyze them holistically.

But to drive innovation and make timely decisions, you need to have the right data at the right time. That’s why it becomes especially important to unify your data sources into one centralized location.

A complete planning platform can accomplish this, as it can integrate data from multiple ERPs and subsidiaries to create a single source of truth, allowing for real-time data aggregation and consolidation.

With easier access to consolidated data, banks and credit unions can quickly get a view into their assets, liabilities, rate assumptions and total earnings. And, no longer having to spend time aggregating and formatting data in various Excel workbooks, they’ll gain more time for analysis, driving better decision making and more strategic organization-wide planning.

2. Rolling Forecasts

During times of higher fluctuation in interest rates, it’s especially valuable for banks to budget, forecast and reforecast faster.

Automating the data entry of your actuals for your budgeting and forecasting processes makes this more attainable.

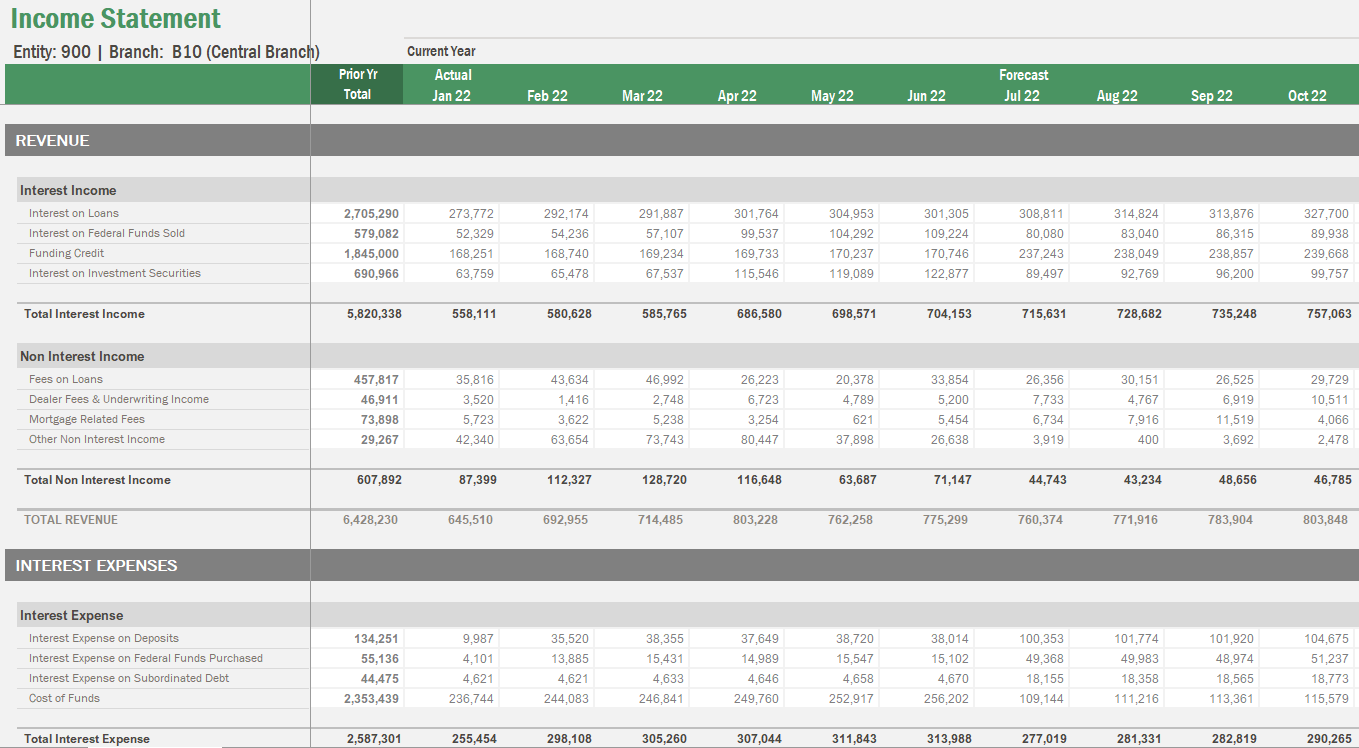

With a complete planning platform that automatically updates your actuals based on a central database, you can analyze your financials in real time, such as your balance sheet, income statement or cash flow statement, immediately after last month’s (or week’s) books close.

You can also introduce a rolling forecast and no longer have to manually load the most recent actuals into your spreadsheets after every reporting period.

Vena automates manual, time-consuming data entry so that your financial statements roll forward and you can spend less time on reporting, and more on analysis.

When Alberta-based bank ATB Financial implemented Vena to accelerate their budgeting and forecasting, it took only three months for Vena to transform their FP&A processes. And now, they use Vena not just for their annual budget, but for producing monthly forecasts. Michael To, ATB’s Director of Finance Data Services, said, “We version it every month so our users have a snapshot of what changes have happened. We can also audit back to see who made those changes, and why.”

3. Scenario Planning

When banks and credit unions consolidate their disjointed data sources and automate their workflows, audits and processes, it becomes much easier to carry out scenario planning.

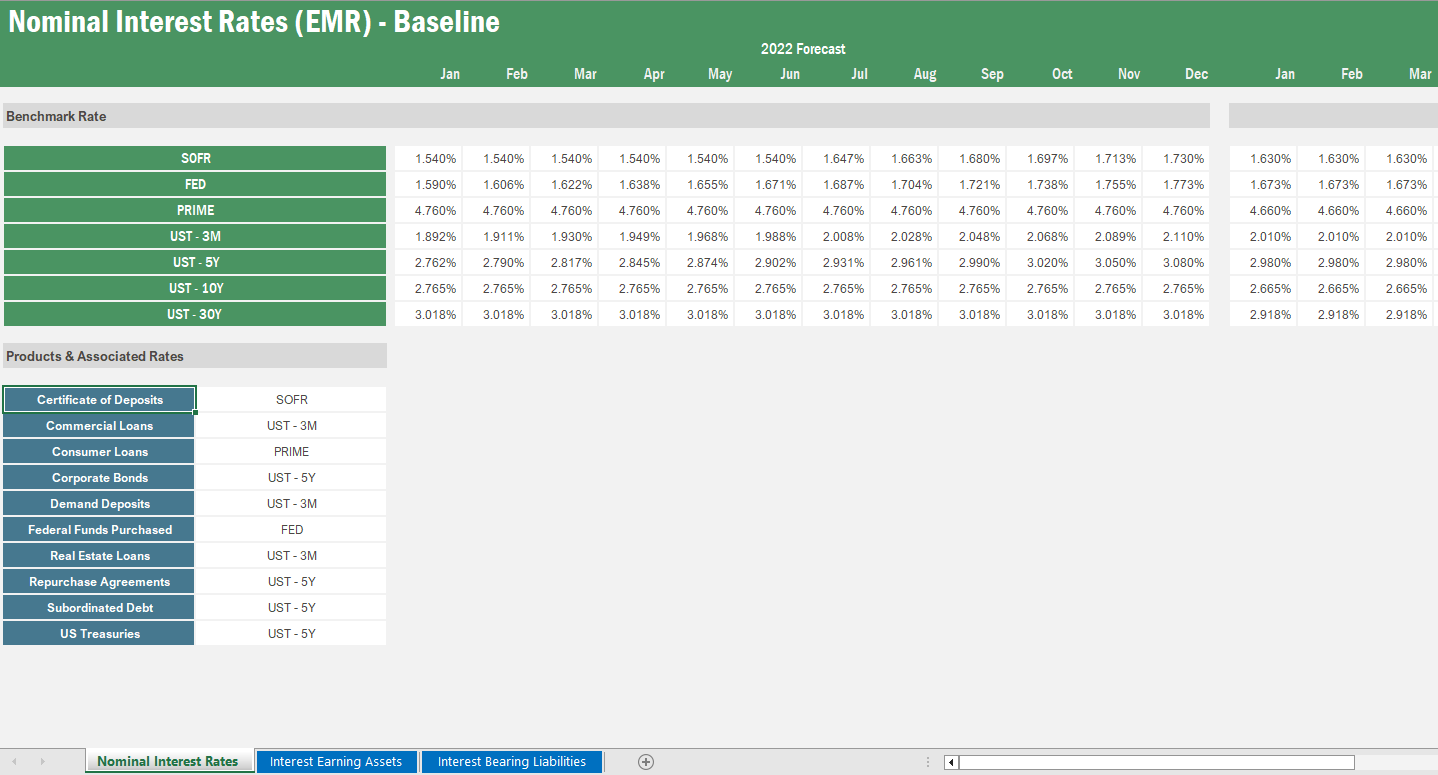

Being able to model for different scenarios (for instance, what would you do if the Fed dropped rates by 50 basis points tomorrow?) helps financial institutions move with agility and mitigate interest rate risk.

When you’re analyzing only real-time numbers and your financial models are connected to a centralized location—as changes occur to your key drivers, such as margins or interest rates—you can run ad hoc analysis and model driver-based scenarios to prepare responses to any number of situations.

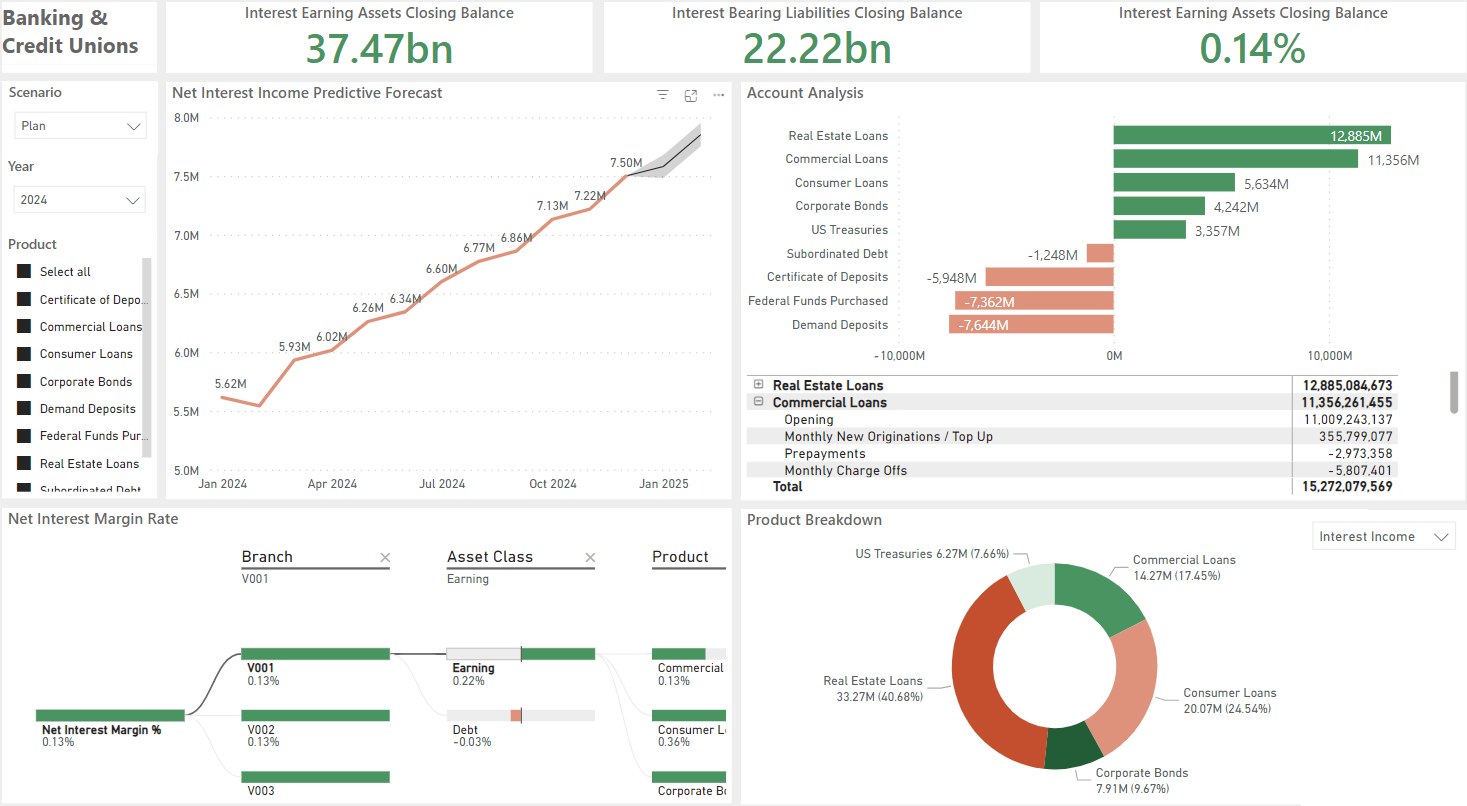

With Vena's pre-configured solution for banks and credit unions, you can quickly model the impact of rapidly changing interest rates on your forecasts.

Whether there’s a recession, new government regulations or any other macroeconomic conditions—when you have the latest actuals available, you can quickly see how these factors impact your bottom line, and then promptly advise your decision makers on how to proceed.

4. Financial Reporting

For financial reporting at banks and credit unions—you have your regulatory/statutory reporting, board reporting, variance analysis and more—the ability to report with greater granularity is key for strategic decision making.

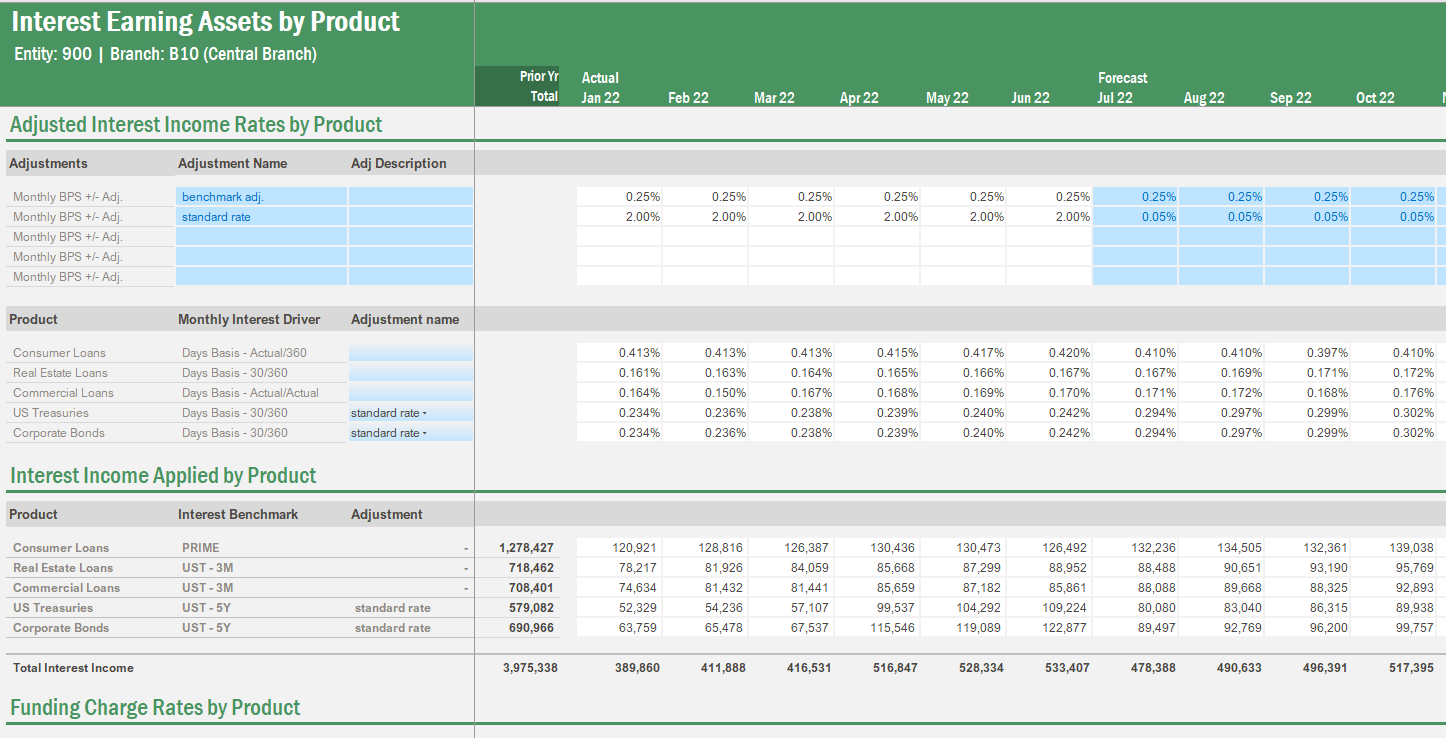

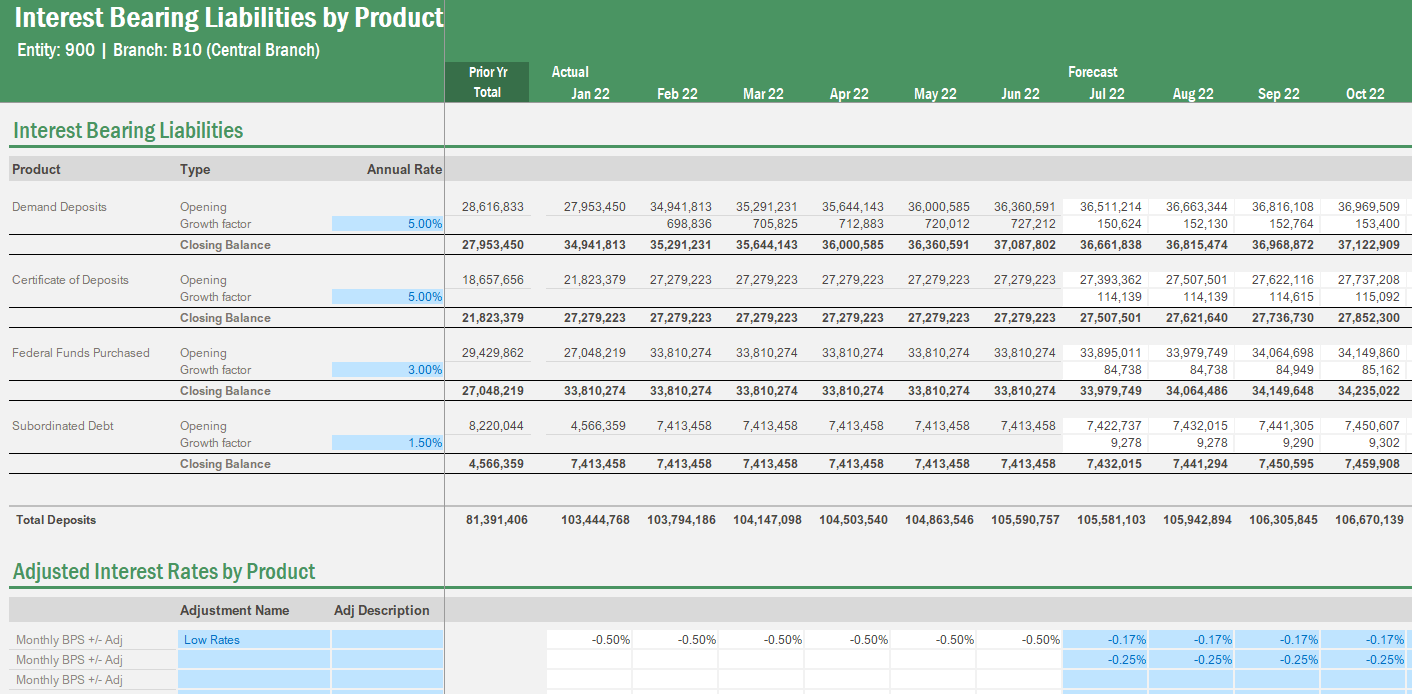

Banks and credit unions need to slice and dice their data across various factors (branch, product, customer margin, loan portfolio, etc.) while setting and tracking goals for the industry’s unique KPIs and metrics (net interest margin, interest earning assets, interest bearing liabilities, risk-adjusted return on capital, etc.).

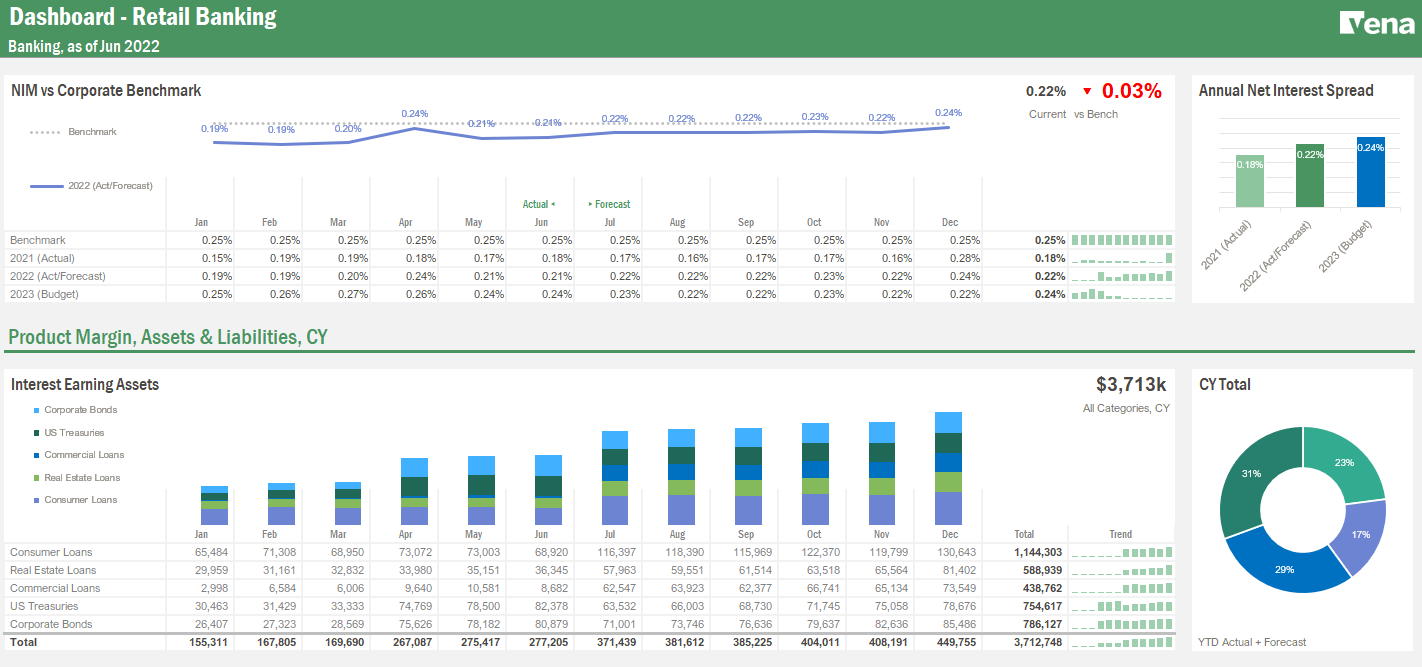

Vena’s purpose-built templates allow you to model and forecast interest income from assets …

… as well as interest earned from holding liabilities.

With Vena, ATB Financial built a net interest income model to measure their consolidated earnings and margin figures for 100+ products. “This is the first time since I've been at ATB that we can achieve models with this level of granular detail,” said. Michael. “We now have the capability to look back at actual vs. budget during our monthly analysis and see, are these variances due to our margins, or due to our price/volume variances? That's something we'd never really talked about before.”

Beyond your ability to source data, the way you deliver and present that data to stakeholders matters too.

Responsive dashboards and data visualization tools tailored to banks and credit unions can help you tell a powerful story, enabling you to share actionable insights with your stakeholders and decision makers at every stage of your planning cycles.

In Vena’s pre-built dashboards for banks and credit unions, you can visualize your top KPIs and metrics such as net interest margin in one place.

With Vena Insights—an Intelligent Reporting and Analytics solution which uses embedded Power BI and Microsoft’s best-in-class AI and machine learning technology—you can visualize your data with even greater granularity.

As interest rates continue to fluctuate, banks and credit unions need to eliminate manual, error-prone processes from their FP&A function to respond faster to changing market conditions.

Leaning on automation is the surest way for financial institutions to keep up with market fluctuations and move with more agility to mitigate risk and maximize profitability.

With a complete planning platform that’s built for the unique needs of banks and credit unions—with customizable templates, data models, connectors and business logic built in—banks and credit unions can quickly and confidently respond to any shifts in the economy.