A recent article published by the Association of Accountants and Financial Professionals in Business described "an on-going transformation that shows the finance function becoming more of strategic business partner within their organizations". This is critical for an organization to remain competitive.

Controllers are not only expected to provide financial data, but to be able to more effectively interpret data and contribute to making decisions for their organizations.

What is interesting about this article is that it highlights a disparity that has been with us for decades: The old school perception that the finance team is solely an administrative function vs. today's profit-making value of the finance department.

As a result, controllers and finance professionals are left wondering just how important they are in the grand scheme of things. In reality, in most organizations management has already learned the growing importance of finance groups in their organizations. They aren't just bookkeepers or "number-crunchers" anymore.

Yet such a disparity, while it may be attributed to a lack of understanding of what the finance department provides or even their lack of knowledge of how accounting works in general, it is indicative of a certain shortsightedness about the finance department's contribution to the organization.

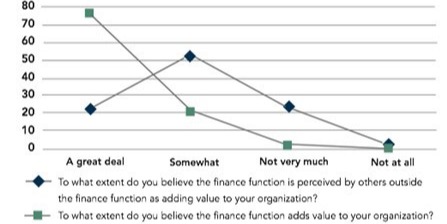

This same article pointed out a very telling statistic about the perception of the role of the finance function in their organization. In a survey of business leaders, 80% of respondents within finance believe the department "adds a great deal of value to the organization", while only 22% outside of finance saw their role in the same light.

In reality, these perceptions couldn't be further from the truth today.

Consider for a moment the impact of technology on the finance department. The ability to get at data and information in a quicker and more efficient manner has emboldened Controllers to increase their value and provide a level of analysis and reporting that is more useful to upper management.

As a result, rather than just providing information, the usefulness of the Controller and their finance group has evolved into a group that can actually contribute with profit-making decisions and value-added analysis. The ability to provide such information is here for the taking, so for those who seem to think that their value is anything less need to consider the following:

For those finance folks that have this perception that outsiders think of them as nothing more than "number-crunchers", remember there is hope. They have the tools to rise to the occasion. As long as they make use of them, they can change that perception.

The post Is There a Perceived Lack of Respect for the Finance Department? appeared first on Blog | Vena Voice | Vena Solutions.