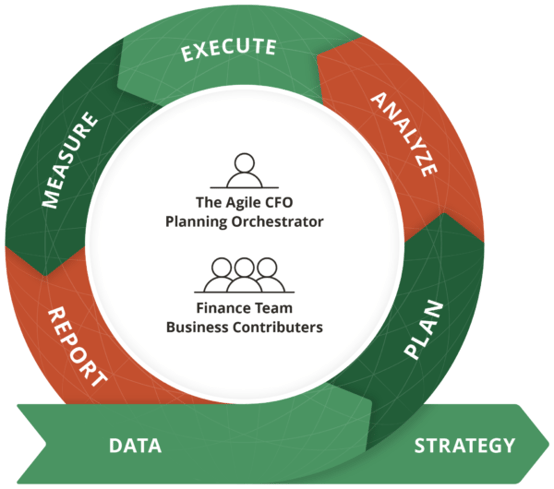

Today, finance teams are at the forefront of change--leading their businesses as they plan for today and tomorrow. With this responsibility comes the need for a new way of working: an Agile methodology for finance-led business planning.

Agile finance-led business planning is about more than just informing quick decision making. It's about providing a platform for adaptability. It's about planning differently and growing smarter. It's about harnessing change.

Agile finance teams value:

- Cross-functional teamwork over a siloed approach to planning

- An evolving plan over staying static

- Empowered teams over burdened individuals

- A growth mindset over fixed thinking

And they follow these seven core principles to guide their way forward.

1. Change is an Opportunity You Unlock With Ongoing Iteration and Optimization

1. Change is an Opportunity You Unlock With Ongoing Iteration and Optimization

At some point, your plan will be wrong. Your plan is important, but your planning process is even more so. Plan and review habitually. Welcome change. Treat it as an opportunity and approach any plan as just one iteration of a continually evolving roadmap. Use forward-looking analysis such as scenario modeling to find ways of harnessing change as a means of establishing a competitive advantage through experimentation and adaptation. Speed up your planning and review cycles and drive more nimble, forward-looking decision making by running your planning process in "sprints." Plan, analyze, execute, measure, report, repeat. A business plan that's meeting your organizational objectives will be your primary measure of progress.

2. You Excel Daily to Move the Business From Accounting Mystery to Planning Mastery

2. You Excel Daily to Move the Business From Accounting Mystery to Planning Mastery

Be proactive and agile in your planning process. Look at leading indicators daily to get a sense of changes on the horizon and what they might mean for your business. Model multiple scenarios in real time with known data-driven variable inputs. Forecast weekly. Always be assessing and managing cash flow. Build more agility and flexibility into your resource reallocation. Report on performance daily to deliver insights that will drive ongoing informed decision making. To be agile, finance teams and key business stakeholders need to be able to maintain a constant pace. Leverage an Agile process on a frequent basis to promote a sustainable approach to finance-led business planning so your business is well poised to pivot quickly.

3. Only by Working as a Team Do You Plan Successfully Through Change

3. Only by Working as a Team Do You Plan Successfully Through Change

To maximize the impact of your finance-led planning process, you need to have the right people involved. Business leaders and finance teams must work together regularly to drive cross-functional alignment by drawing teams out of isolation and into open communication. Collaboration is the process, teamwork is the result--cross-functional teams must plan and act in unison under a common goal and shared vision so the organization as a whole can effectively plan and adapt to change. Regular input from cross-functional contributors is critical for providing finance teams with access to the leading indicators they need to create early warning systems. These enable organizations to anticipate change, to drive plans for any scenario and result and to pivot quickly when required. Take the lead in tearing down data silos to create a unified view of financial and non-financial data so all teams can move from different spreadsheets to the same page.

4. Through Continuous Learning and Improvement, You Pave the Way to Execution Excellence in Business Planning

4. Through Continuous Learning and Improvement, You Pave the Way to Execution Excellence in Business Planning

Develop finance teams that:

- Are inquisitive

- Want to learn

- Strive to be better

- Are detail-oriented

- Are theoretical

- Are creative

- Believe and act like they are contributing to the betterment of a whole--to help propel the business forward

Inspire your teams with aspirational goals. Motivate them to perform key tasks with exact precision and strive for incremental improvement as they work to perfect their craft and achieve executional excellence. Encourage them to go beyond the two-dimensional spreadsheet, to combine data from multiple sources and to reveal the story behind the numbers.

5. Through Storytelling, You Inspire Action and Alignment

5. Through Storytelling, You Inspire Action and Alignment

To drive informed decision making across the entire organization, you must be a master storyteller. Working through business plans in a cross-functional context and getting business leaders on the same page is critical for maintaining alignment across teams. Work with key stakeholders to communicate value in a universal language--how your business planning for any scenario will impact cross-functional departments. Bring together data from across the business to provide a holistic, easy-to-understand view of organizational performance. Know your audience, be a master of persuasion and know how to get people to listen, act and understand the why behind the action.

6. You Use Technology to Maximize Accuracy and Efficiency

6. You Use Technology to Maximize Accuracy and Efficiency

Simplicity leads to speed and the best plans emerge from self-organizing teams. Amplify your planning process with technology and give teams across the business the tools and data they need for your business to succeed. Automate tedious manual work to save time for impactful, forward-looking analysis. Improve cross-functional collaboration by consolidating data from existing systems and creating an integrated ecosystem for finance-led business planning. Always be on the lookout for emerging tools and technologies that will allow you to provide better, smarter insights to the business.

7. To Build a Healthy Business, You Look Beyond the Bottom Line--And Offer a Different Perspective on Growth

7. To Build a Healthy Business, You Look Beyond the Bottom Line--And Offer a Different Perspective on Growth

Change isn't possible without a culture that supports it. Create a culture that's predisposed to embracing change. Build projects around diverse, motivated individuals and give them the environment and support they need to excel. Bring your teams together at regular intervals to reflect on how they can become more effective and then tune and adjust the approach accordingly. Promote ethical leadership and create a culture of ethical accountability. Empower growth wherever you can and motivate your teams to build a healthier business that goes beyond the bottom line. This includes diversity planning, sustainability initiatives and a philosophy of corporate citizenship that understands companies are defined by more than just their bottom line.

Inspired by the Manifesto for Agile Software Development