A successful Chief Financial Officer (CFO) integrates your business's financial team with your services team. A strong financial background alone, however, isn't enough anymore.

In today's market, technology is more integrated with financial services than ever before. This has consolidated services that were performed by multiple departments into one role: the CFO. Successful CFO candidates now need experience with fintech, digitalization and online marketing.

While this shift in expectations for the CFO role predates the pandemic, the past two years have no doubt accelerated the change in expected CFO competencies.

Key Takeaways:

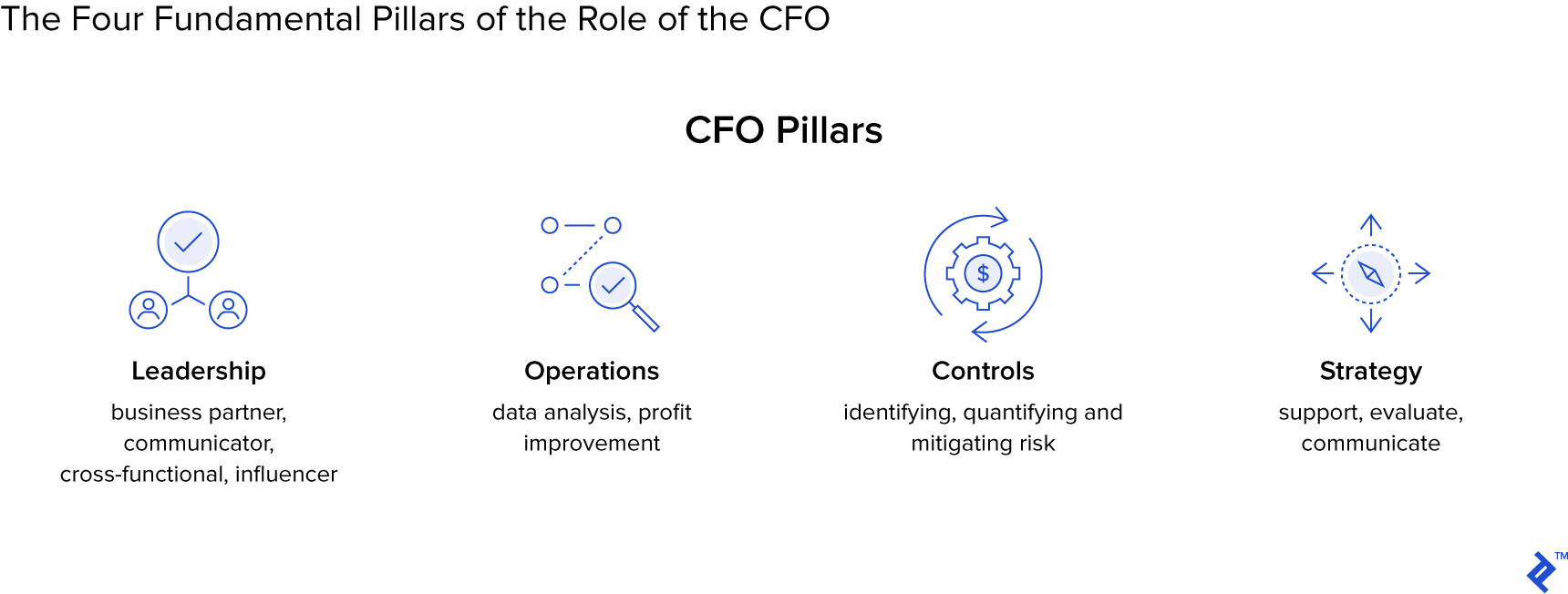

- The CFO's function traditionally was to manage the budget and protect critical assets. Today, leaders expect CFOs to play a critical role in charting the company's future strategic performance.

- Successful CFOs provide value by forecasting future performance, planning how to achieve those goals, monitoring business performance and reacting with agility when changes in market conditions arise.

- Combining tech skills with financial wherewithal allows the CFO to manage risk, implement new technologies and lead the financial team with emerging strategies.

The Role of a 21st Century CFO

A recent survey found that over half of CFOs reported increased demand from C-level executives after the first two years of the pandemic. Because of their access to comprehensive information, CFOs can obtain key insights from internal stakeholders even in a remote work environment.

Source: Toptal

Today, the CFO must wear multiple hats. The rapidly accelerating pace of remote work has further caused business leaders to rely on CFOs to perform multiple tasks. These include roles in human resources, operations, sales, marketing and technological infrastructure projects.

The three most sought-after CFO duties include:

- Increasing digitalization by upgrading technological infrastructure

- Integrating new technologies into the organization

- Developing the organization's products and services

CFOs can perform these duties and hit key performance measures by adopting the following strategies or skill sets.

1. Championing Technology

The CFO has a unique vantage point from which to envision the company's future. At peak performance, the CFO supports employee acquisition and retention and enables the business to weather unexpected global or market events.

First, the CFO must serve as a champion of new technology. They must herald new technology implementation and process execution. Using new technologies as appropriate makes the business more adaptable--ready to handle the next crisis.

Similarly, your CFO can implement automation. By automating routine processes, your CFO frees the finance team to perform higher-value tasks. This includes achieving business growth objectives and reviewing comprehensive data.

With a forward-looking CFO at the helm of your finance department, expect tech spending to increase.

2. Encouraging Inter-Departmental Collaboration

The CFO has access to comprehensive business analytics data and budget performance metrics. They can play a more visible role by reviewing key insights from all performance levels.

Rather than hoard this information, CFOs can encourage transparency and build employee buy-in by sharing that data. For instance, a CFO should prioritize weekly check-ins with both C-level executives and mid-level management. This creates space for a productive dialogue among leadership.

Your CFO should also provide an overview of critical key performance indicators in at least monthly intervals. This gives employees a broader understanding of business objectives and helps them envision their own achieving company goals.

Every team member has a sense of ownership.

Similarly, transparency also improves employee loyalty. Your CFO can use these meetings or other data sharing processes to reduce turnover, increase employee engagement and build higher customer satisfaction.

Finally, the entire finance team--beyond just the CFO--should spend time familiarizing themselves with other business departments and key stakeholders within them. This provides a wider understanding of company goals and assists the finance department in focusing on value creation for the organization as a whole.

3. Driving Digital Transformation

The pandemic facilitated the wide-scale adoption of remote work across industries. This created an opportunity for companies to adopt new technology platforms and services geared toward replicating in-office productivity at home.

CFOs should take advantage of this transformation by increasing digitalization.

For instance, successful businesses have already shifted to data-driven decision-making models. Further adoption of automation and machine-learning technologies by CFOs increases productivity by:

- Standardizing Workflows: Accurate, real-time information collection enables C-level executives to make more informed decisions

- Facilitating Remote Closing: Using sophisticated accounting technologies allows geographically widespread financial teams to close accounting periods remotely with ease

As a company leader, your CFO can demonstrate that technology is empowering. The CFO can also make the business case for technological upgrades, which provide a competitive advantage.

Skill Sets of Successful CFOs

The most important skill of a successful CFO is the ability to continue learning.

Source: Andrew Rudchuk

An always-learning CFO keeps abreast of business and technological trends, provides insights that drive profits and growth and quickly generates high-quality conclusions.

Other top skills include:

- Technological Literacy: Adapting to new technologies requires the CFO to understand the value and abilities of new technology. They must also prepare for continuing education and technological management

- Strategic Planning: The repercussions of the global pandemic have caused inflation and prolonged supply chain woes. The stock market now reflects this volatility. C-level executives need to rely on your CFO to guide procurement and general business decision making with limited resources and rising costs

- Digital Adaptability: The role of the CFO traditionally included baseline budgeting and financial management issues. But rather than manage information, today's economy requires the CFO to analyze this information for future planning. This includes strategies like flexible budgeting, forecasting business performance and mapping costs

As the Role of CFO Continues To Evolve, So Too Should Your Skillset

The CFO position was already in flux, but the past two years have accelerated the change. The role of a successful CFO is no longer limited to budgeting and asset management--today's CFOs must wear multiple hats, including human resources, operations, finance and more.