We all probably accept the old adage that you can't manage what you can't measure. But what if you can't avoid managing it - and have to take at least some steps towards trying to measure it?

It's not that finance teams lack key performers indicators, necessarily. It's just that, as a recent report from the Chartered Global Management Accountant (CGMA) organization recently pointed out, there are some areas that may be ignored at a CFO's peril.

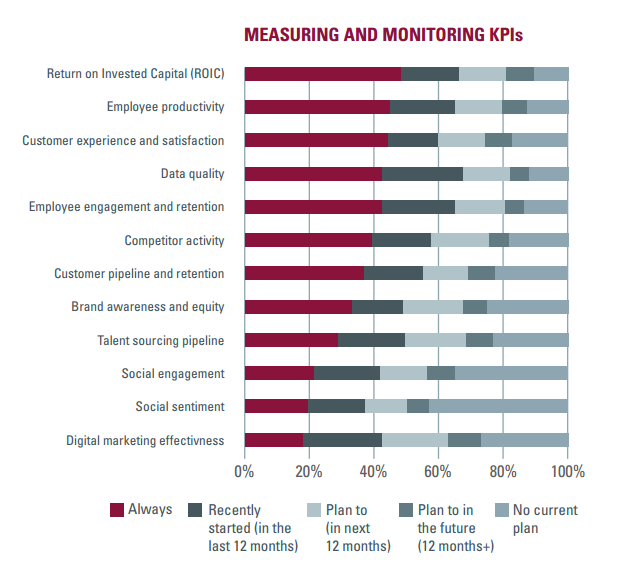

The report, The Digital Finance Imperative: Measure and Manage What Matters Next, was based on more than 800 survey responses as well as one-on-one-interviews with finance leaders, and it showed that less than half of companies are looking at things like how effective their digital marketing is today or whether customers are engaging on social media.

The report's authors suggest this isn't due to a lack of willpower or diligence by finance departments so much as not having the right tools:

To measure intangibles, businesses must make connections between financial outcomes and pre-financial measures that they can use as leading indicators, usually based on a causal relationship or correlation. However, can businesses assemble and analyze the data needed to measure intangibles?

Beyond picking the right technology, the report suggests finance teams should start by making correlations between the KPIs they track today and the things they believe deliver the most value to their organization. According to the survey, the top five value driver are all the things you might expect: customer satisfaction, business processes, customer relationship, quality of people and reputation of the brand.

KPI Connections

All these things can align well with the top eight KPIs that are monitored by more than 50 percent of those featured in the study. A KPI such as data quality, for example (which was the most-cited by 67% of the sample), can tie directly to a value driver like the quality of a firm's business processes. Employee productivity, which came in at 65%, obviously dovetails nicely with a value driver like quality of people. Still, the second most popular KPI at 65%, return on investment capital, may require more thought around its relationship to value drivers.

This is where the best CFOs shine, of course. In fact, the CGMA report is well worth a read not only for the statistics but also for some of the quotes from finance leaders. This one, from LinkedIn's vice-president of finance Richard Wong, seems like a perfect way to end off:

"The fundamental responsibility of finance is financial reporting, and compliance and risk management. These have to be done right," he said. "On top of that, finance is responsible for allocating resources; shaping and defining strategy; using all the data to help leadership - the CFO is a co-pilot who can also pilot the plane; projecting into the future - looking into risks and opportunities; total understanding of the value chain and value drivers."