Now our stakeholders can get detailed profitability reports with a button—and that’s where I think the power of Vena shines through for us. Everyone always has the data they need to make the right decisions and help the business succeed.”

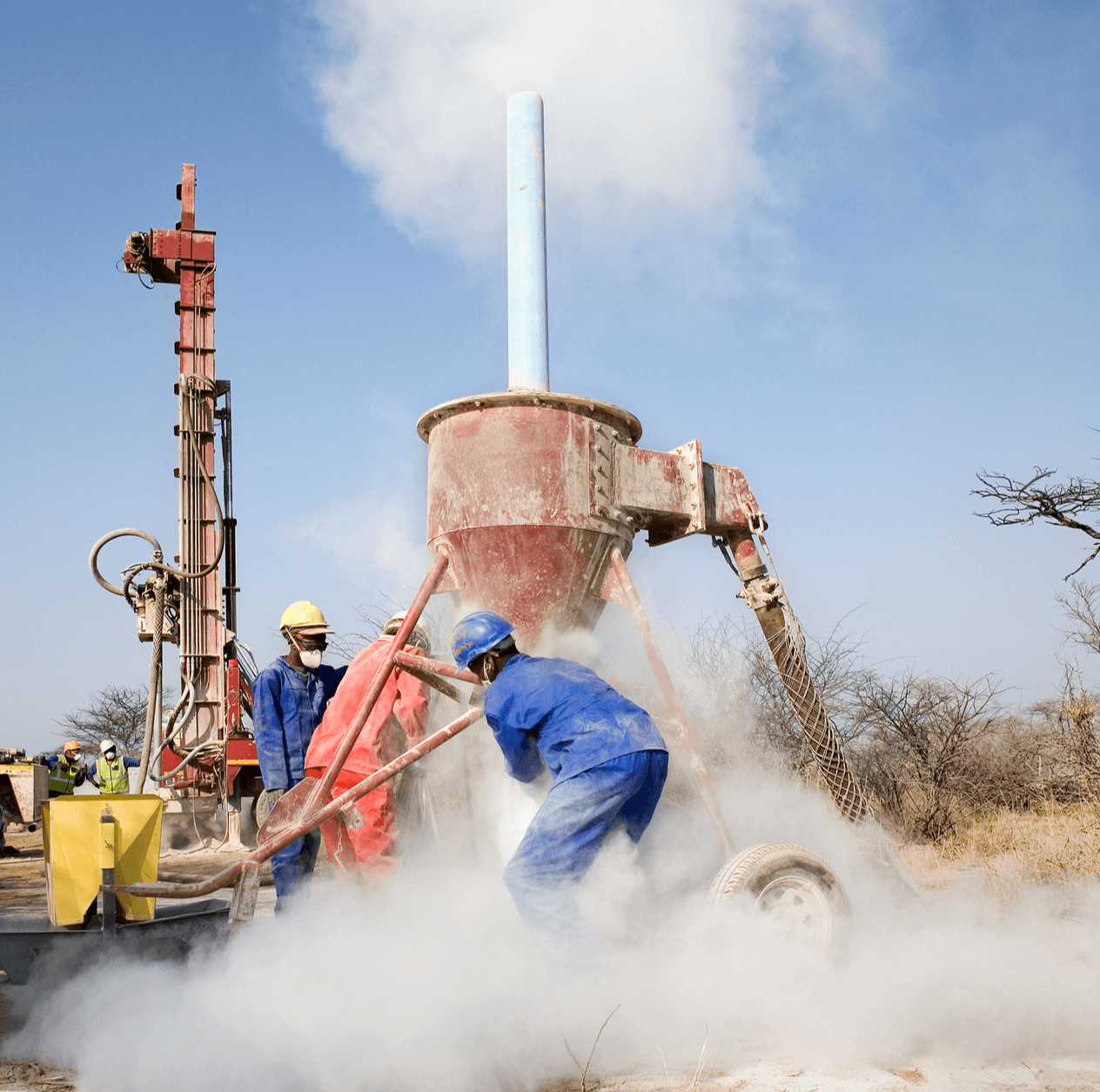

Mani Alkhafaji has always been close to First Majestic Silver’s growth journey since joining the company in 2015. As VP of Business Planning and Procurement, he plays a key role in the mining giant’s budgeting, forecasting and overall business planning efforts—both at the corporate level and for individual mine sites.

But prior to implementing Vena, building a coherent budget was a big challenge for the finance team. Everything was done using offline Excel spreadsheets which caused a lot of data integrity issues both for Mani and his controllers on the ground.

“I inherited this massive Excel model that had a scary 256 tabs,” says Mani. “Our mines are all located in Mexico, so the controllers from those sites would all input their budget numbers and send us different versions of that. We couldn’t track who had done what, and sometimes people wouldn’t use the proper assumptions or formulas. It caused a lot of frustration.”

First Majestic’s budgeting cycle is about three months long, but that entire time was always spent compiling the budget rather than analyzing it. As a result, Mani couldn’t empower leadership with a reliable long-term business outlook—which made it tough to plan confidently for future capital investments and growth opportunities.

“We’re a very dynamic company. We’re always looking at acquisition opportunities and adding new sites to our portfolio,” says Mani. “But if your processes are all manual, it’s harder to see the big picture and quickly map out how those investments might work for the business.”

After doing some work internally to clean up his existing Excel models, Mani partnered with Vena in the Spring of 2018. He’d previously evaluated Planful as well as Workday Adaptive Planning, but ultimately chose Vena for two main reasons: The platform’s native Excel interface and the ease of a finance-owned solution.

“We definitely needed a database, but we didn’t want to change our templates too much. The ability to stay in Excel was huge for us,” says Mani. “And given how fast the company was growing, we also knew we needed something that would allow the finance group to make tweaks on the fly. The other softwares we looked at were just too reliant on IT consultants.”

The freedom to design workflows and perform what-if analysis on demand were other major reasons why Vena was a perfect fit. Today, Mani can model business scenarios based on any number of assumptions in minutes—which is especially crucial in the mining sector where metal prices and labor markets are volatile.

“You always have to be looking ahead in this industry, and Vena makes that really easy for us,” says Mani. “All of our templates are automated, so now I’m not emailing files back and forth or saving scenarios on multiple spreadsheet tabs. Everything I need is right there at my fingertips in Vena.”

Now that First Majestic’s planning data is consolidated in one system, only half of the three-month budgeting cycle is spent compiling the budget itself. The rest of that time is spent analyzing, optimizing and modeling potential investment scenarios so Mani can present management with the most reliable business plan possible.

“Now I actually have the time to look at our budget and say, ‘If silver prices go down, does this investment still make sense? And if prices go up, where will that extra capital go? What will this look like two years from now?’” says Mani. “Analyzing investments on a standalone basis is one thing, but there’s a different flavor to it when you inject that into your business plan and look at the long-term impact.”

Another win with Vena has been a higher level of ownership among all of First Majestic’s cross-functional budget owners. Now that everyone is working from the same connected templates, Mani has greater trust in the numbers his colleagues are reporting.

“We’re seeing more accountability, more transparency and more engagement across business units. That’s something we never really had prior to Vena,” says Mani. “Now our stakeholders can get detailed profitability reports with a button—and that’s where I think the power of Vena shines through for us. Everyone always has the data they need to make the right decisions and help the business succeed.”

Over 2,000 leading companies grow with Vena. Start your journey today