Trust in our numbers and trust in our business plans comes from accurate, consistent and timely financial information. Vena helps us consistently nail it.

Brian Downs has spent his whole career helping Shift4 Payments thrive. In his 16 years on the finance team at Shift4—an innovative payments processing firm—he’s held managerial positions, director roles and now serves as Senior VP of Finance and Treasury. As Shift4 continues to blossom into a shining star of the payments industry, Brian always ensures finance fulfils its purpose as a planning powerhouse by delivering insights and bottom-line analysis on millions of processed transactions.

However, prior to implementing Vena, meaningful profitability analysis was a lot harder to execute for Brian and his colleagues in finance. In those days, tedious copy-and-paste spreadsheet processes meant it took a whole week to generate reports after the month-end close was complete. As a result, reported metrics would be outdated by the time they were shared with stakeholders—and finance didn’t have the bandwidth to focus on making the business more efficient.

“We process billions of dollars in volume. We couldn’t afford to spend all our time fetching and validating data. We needed to be analyzing data,” says Brian. “We’re essentially counting pennies in this business, but pennies can hide in big datasets like ours. If we’re not really digging into our numbers, we might miss little variances highlighting that something is off. And over millions of transactions, those pennies can translate into very real dollars.”

Brian also grappled with input errors before Vena, which he attributes to the sheer complexity of consolidating GL data with reporting hierarchies in Excel. After a series of major acquisitions at Shift4 with even more growth on the horizon, Brian knew he needed a solution to help their planning process flourish at scale.

“We had one Excel workbook that only one person could work in at a time. This lent itself to an unacceptable degree of natural human error,” he says. “It just wasn’t sustainable for the reporting demands being placed on my team.”

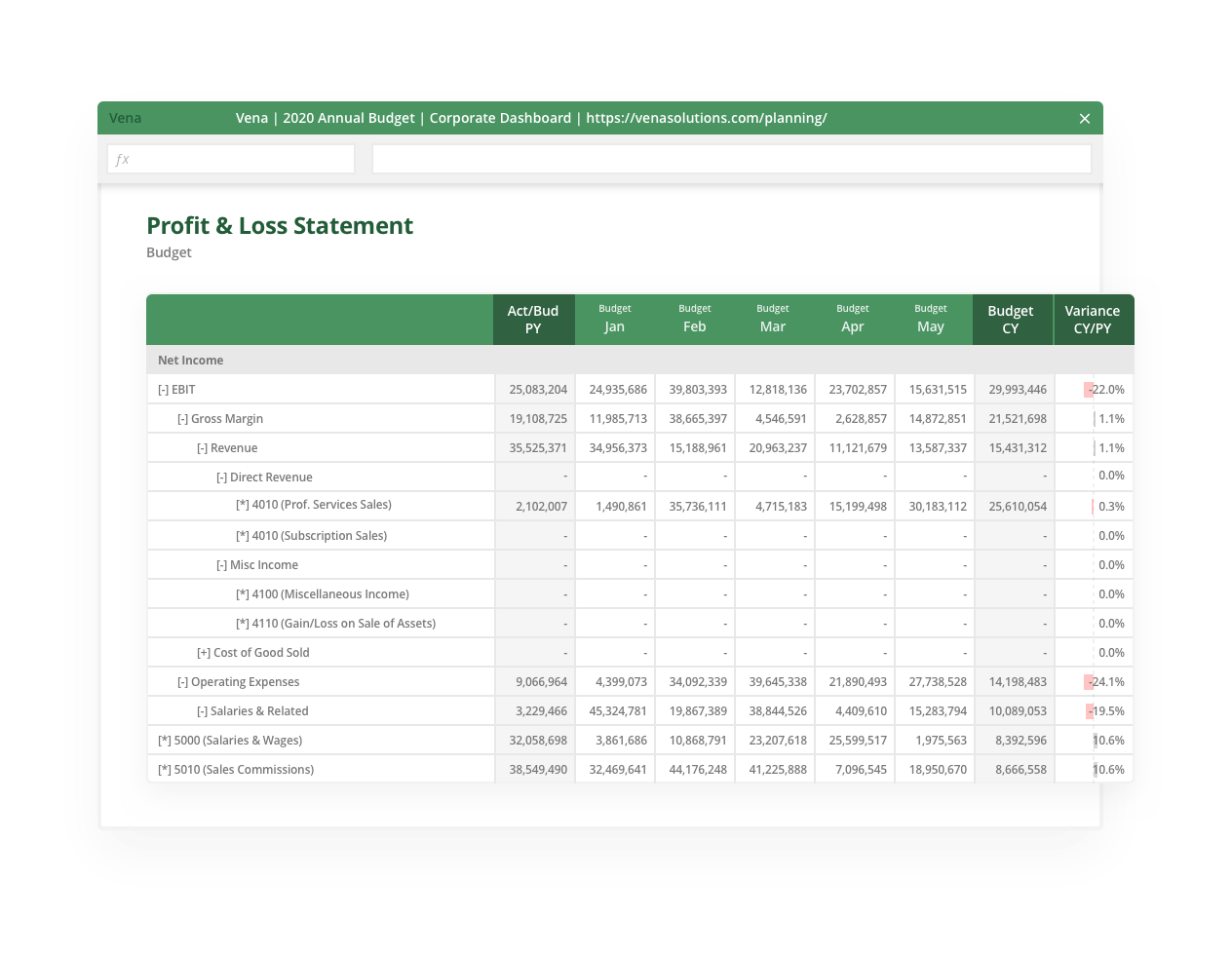

When Shift4 partnered with Vena in the Spring of 2018, Brian’s top priorities were to streamline monthly reporting, design a more flexible planning process and empower cross-functional stakeholders with reliable insights into real-time business performance. With Vena’s Complete Planning platform, Brian automated the flow of data from Shift4’s Oracle ERP Suite (and other systems) into a central database—providing one connected platform for budgeting, forecasting, reporting and scenario modeling.

“Now we’re able to produce accurate reporting in a matter of hours, sometimes minutes. That’s because we’ve invested so heavily in dimensional design and maintaining our data models in Vena,” says Brian. “Trust in our numbers and trust in our business plans comes from accurate, consistent and timely financial information. Vena helps us consistently nail it.”

Scalability across cost centers and ease of use were critical too, given how quickly Shift4 was growing and adjusting to new business requirements. Once FP&A was humming along nicely in Vena, Brian helped streamline other spreadsheet-based processes—specifically HR modeling and settlement balancing/account reconciliation—but without forcing his colleagues to abandon their comfort with Excel.

“Vena let us leverage native Excel as our primary interface, which ultimately allowed our user base to keep their existing templates. We didn’t have to start from scratch,” he says. “This was critical because we need that flexibility to adapt to changes in the business. I couldn’t imagine doing this with a tool that’s just ‘Excel-like.’”

Settlement balancing in particular was a big win for Shift4. Today, thanks to a purpose-built data model in Vena, Brian and his teammates reconcile customer accounts daily to ensure all of Shift4’s merchants have their funds processed correctly.

“We needed to make sure the data was easily accessible for daily balancing as well as analysis. Vena provided the perfect plan, platform and implementation resources to help us do both efficiently,” says Brian. “Overall, we’ve been able to go deeper into our data more quickly and offer better, more consistent service to our customers.”

In June 2020, after months of rigorous effort working remotely during the global pandemic, Shift4 Payments successfully went public (NYSE: FOUR). The IPO was a huge undertaking for the entire finance and accounting group, but Brian says it was all made easier thanks to the reporting structure they’d developed in Vena.

“One of the heavier lifts during this process was revisiting our historical financials. It was so important for my team to be fully in sync with the accounting team,” he says. “Vena gave us the ability to input topside adjustments via a template and give us our first system-generated historical results under PCAOB audit standards. That very same formatting is now in our Ks and Qs.”

Today, Brian and his cross-functional colleagues are collaborating better than ever before as they all continue to adjust to the realities of public company life. Instead of rushing out reports that are based on outdated actuals, Shift4’s finance team is a partner to every arm of the business—giving decision makers the data they need to lead confidently through this next phase of growth.

“For me, all of this really boils down to better outcomes for the business. When everybody is rowing in the same direction and with the same rhythm, it’s a smoother ride,” says Brian. “You need reliable infrastructure and that’s what we have with Vena. When I think back to when we were a small company, I still marvel at how we even did anything back then, compared to how professionally the team carries out our business today.”

Over 2,000 leading companies grow with Vena. Start your journey today