Vena is a great solution for presenting data in whatever format I need.

The largest expense item by far on the income statement at Citizens Advice is headcount. This is pretty common for nonprofit organizations—and as one of the largest charities in the U.K. providing free advice to millions of people, Citizens Advice can’t fulfill its mission without allocating their staff efficiently.

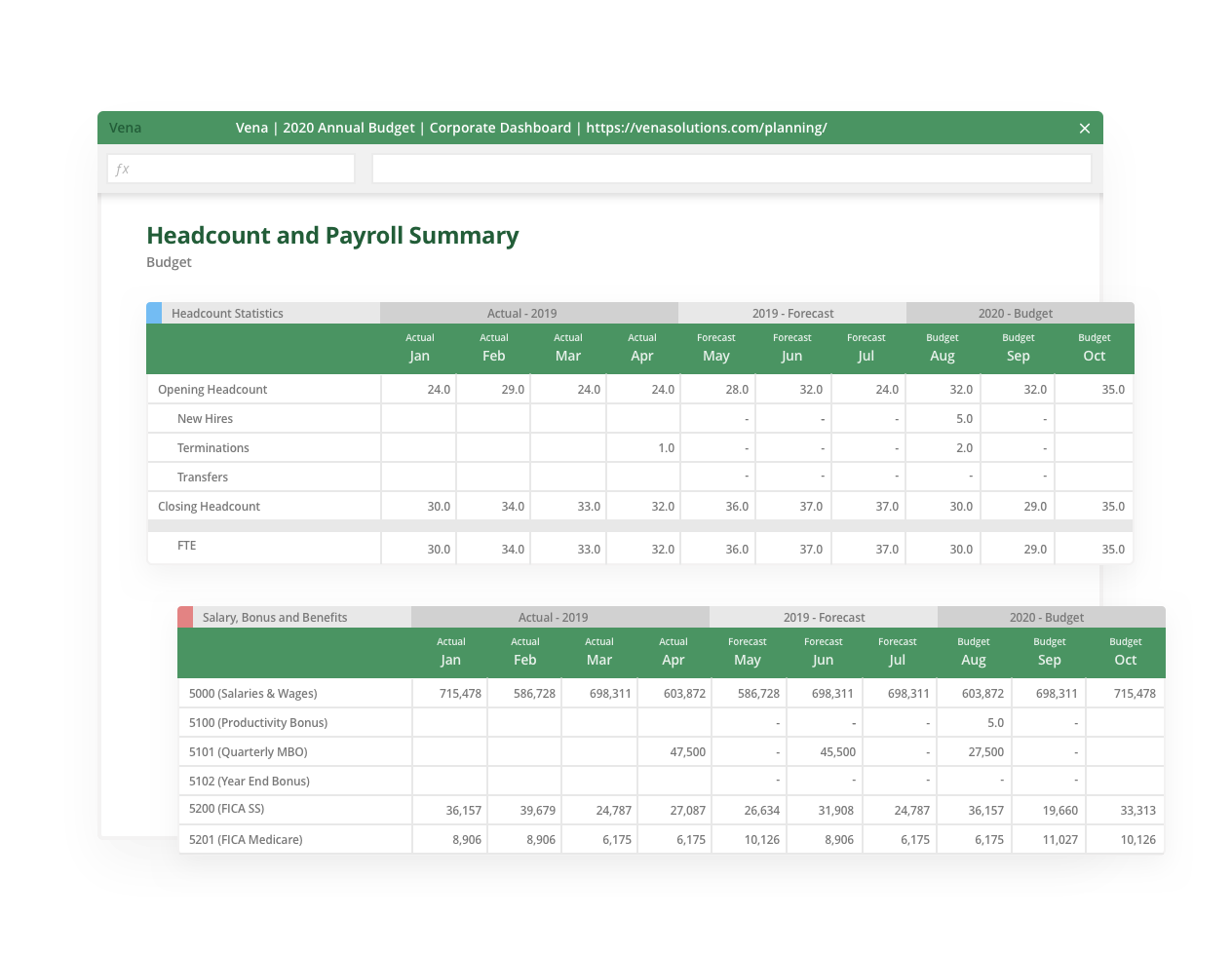

However, prior to partnering with Vena, workforce planning at Citizens Advice was largely siloed in finance. Budget holders across the organization had less visibility into how their headcount budget was derived for them—making it harder to plan projects efficiently and to make the most of their funding.

“So much of our costs are around staffing, but all of that was managed with spreadsheets and concentrated in finance before Vena,” says Kate McKenna, a Senior Management Accountant with Citizens Advice. “We were keen to get away from spreadsheets due to the potential for manual errors. We wanted to empower the organization with a more accurate view of our costs.”

According to Josh Weinberg—a close colleague of Kate’s and the Head of Financial Systems and Change at Citizens Advice—the lack of engagement from budget owners was the biggest catalyst for change. The charity’s previous budgeting system was rigid and difficult to use, so he knew he needed a solution to help make workforce planning easier for everyone.

“The changes we wanted to make were ultimately to our budget owners’ behaviour,” says Josh. “If our budget owners were more involved in headcount and strategic planning overall, we knew we’d have a better understanding of our opportunities to spend money more wisely.”

Citizens Advice partnered with Vena in the fall of 2020 with the primary goal of “refreshing” their entire budgeting and forecasting process. Josh was especially impressed with Vena’s workflow builder and native Excel interface, which both minimized the change for budget holders and simplified the finance team’s management role.

“Now there’s a lot more ownership from budget owners surrounding their staffing,” he says. “And whenever a planning cycle opens, they all just log into Vena and it's clear where to input their income and expenditure numbers. The finance team can track the status of those inputs really easily, while audit trails and data validation rules mean there’s no danger of the numbers being wrong.”

Having up-to-date numbers on demand has made reporting more seamless as well. Today, instead of juggling spreadsheets with limited insight into headcount cost drivers, Kate just clicks a button in Vena to see any department’s headcount or project budget. That’s because Vena pulls actuals from their ERP automatically every night, while headcount data from the charity’s HR system is re-uploaded to Vena monthly.

“Vena is a great solution for presenting data in whatever format I need,” says Kate. “Our budget owners use those same reporting templates for their budgets and forecasts as well. That’s been really valuable. I didn’t have that flexibility with the tool were using before.”

Now that Citizens Advice is powering growth with Vena, Kate and her colleagues in finance are spending more time on strategic analysis. Instead of spending hours on spreadsheet work with multiple versions of the same template floating around, finance business partners work closely with budget owners to ensure their headcount and OpEx budgets make sense.

“I wouldn’t say our budgeting cycle is any faster from start to finish, necessarily, but the work we do every day is more valuable and a lot more efficient,” she explains. “Budget owners are more engaged now and they’re doing a lot of forecasting themselves. It frees up time for the finance team to collaborate with each budget owner to determine what their headcount numbers should actually look like—and why.”

Josh says his biggest result with Vena has been the confidence to build reliable scenario models. A prime example of that in practice is his “funder budget” in Vena, which is a template to help his team analyze the impact of new funding bumps that occur unexpectedly.

Now instead of struggling to track funding adjustments throughout the year, the finance team adjusts inputs proactively and models the impact of those changes in seconds. Their existing budgets and forecasts all remain intact, but now Josh and his teammates are always ready to make the most of new funding scenarios—significantly improving the relevance of any reporting to affected budget holders.

“Vena has given us the freedom to do analytical work that we just couldn’t do previously,” he says. “We set some pretty challenging success criteria right from the start of the project, but Vena was able to deliver in a quick and professional manner. This is the platform we needed to help us better manage our finances, better manage our workforce and ultimately make a positive impact on the communities we serve every day.”

Over 2,000 leading companies grow with Vena. Start your journey today