All businesses engage in budgeting and forecasting activities to some degree--and if you're an executive, finance leader or operations professional, improving your budgeting and forecasting processes should always be a top priority.

So what is budgeting, what is forecasting and why are they both so critical? To appreciate what they are and how they contribute to organizational success, let's unpack budgeting and forecasting and drill into challenges, best practices and major differences between them. Read on to discover:

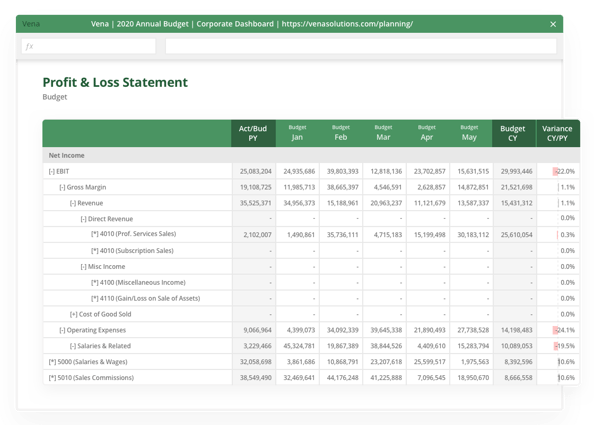

Budgeting is the process of planning your company's revenue and expense figures for a specific period of time. It involves identifying available cash flows and allocating financial resources for your company's required spending.

Here are the primary characteristics of a typical corporate budgeting process:

Budgeting allows you to chart your organization's path and assist your management team with strategic business planning. There's many different types of budgeting processes, from incremental to annual budgeting. No matter the method you choose, the process results in a clearly defined plan that's reflective of your company's financial and operational goals. Typically prepared annually, budgets provide important guidance regarding what your business can expect to accomplish that year.

Budgeting also has plenty of other benefits, including:

However, because budgets are prepared so far in advance and based on a fixed set of assumptions, they can quickly become outdated as soon as those assumptions change. This is where forecasting takes over--when budgeting can't meet certain time-sensitive needs.

Forecasting is the process of analyzing historical trends in order to predict future business results based on your company's most up-to-date actuals. Done over a compressed time frame, forecasting typically focuses on major expenses and revenue line items.

Here are the main characteristics of the forecasting process:

![]()

When done efficiently and with reliable data, forecasting gives you the insight you need to reallocate resources proactively and help your managers make data-driven business decisions. There are plenty of other benefits to forecasting, including:

Budgeting and forecasting are complementary, but they're definitely not the same. Before we get into best practices and common challenges with budgeting and forecasting, let's break down the key differences between them.

We already know that budgeting is figuring out how much money your company will need to spend in order to achieve its desired business results. Forecasting, on the other hand, is about proactively analyzing the budget and using both historical and real-time data to predict what those business results will look like.

Check out the table below to better understand the key differences between budgeting and forecasting:

| Budgeting | Forecasting | |

|

|

1-5 years |

Periodic Forecasts: The rest of the current fiscal year. Rolling Forecasts: Usually the next 5 quarters or more. |

|

Average Preparation Time: |

3-6 months |

1-4 weeks |

|

External Disclosure: |

Not Disclosed |

Disclosed (at least for public companies) |

|

Reliability: |

Less reliable later in the year when the numbers are outdated. |

More reliable because they're based on up-to-date actuals. |

|

Best Used For: |

Formulating high-level strategies and business goals. |

Targeted decision-making in specific areas. |

Think of it this way: Your budget is your road map, highlighting key financial checkpoints for every phase of the business journey. But once that journey has started, it's common for circumstances to change, ultimately outdating the original assumptions that were made when the budget was created. For proactive finance teams, best practices involve regularly reviewing your budget against the changing business environment, forecasting accordingly to determine where the numbers are headed, then adapting your plans as required.

Budgets should always be as thorough and as detailed as possible. Generally speaking, your budget should include the following information:

As you build your company's budget, it's crucial that you follow these steps:

As you progress through your budgeted period, you should update your forecasts periodically as soon as your latest actuals are confirmed. This will give you a clearer picture of how your business is performing against your budgeted goals.

Here's how to generate reliable financial forecasts:

Periodic forecasts are beneficial, but they usually only project out to the end of the current fiscal year. Rolling forecasts, on the other hand, are even more useful because they extend beyond that timeline.

Rolling forecasts are generated monthly, quarterly or weekly to help you plan for a defined period that's beyond the scope of the annual budget--such as the next five quarters, for example. So instead of just projecting out to the end of the fiscal year, most rolling forecasts will predict the next 12 months or more. Once a fiscal month or quarter has been actualized, your forecast just "rolls" over to the next period so you never lose sight of your long-term business trajectory.

Rolling forecasts are important for the following reasons:

The budgeting process is hard work and there will likely be challenges along the way considering timeframes and all of the variables at play. So focus on the big picture, lay out a plan that makes sense and acknowledge that course corrections will need to occur along the way.

Here are 11 key steps you can take to run an effective budgeting process for your business, and of course you can use a budgeting and forecasting software to make your task easier.

To accurately assess the future, you need to understand the now. For example, what is your say:do ratio? Did your business lay out operational plans and achieve their respective corresponding KPIs and metrics in the first half of the year? Were goals under or over achieved? You need this context to correctly inform future forecasts and financial targets. Remember--your forecast and budget are just articulations of your operational and strategic plans. Identifying the who, what, where, when and why of your business activities will help guide your budget.

Leverage your long-range plan (LRP), also referred to as a target operating model (TOM), by syncing with your CFO and CEO to provide guidance to the rest of your executive team. Ensure there are no fundamental changes in your business strategy and that this high-level guidance reflects the company's growth rates and corresponding investment levels.

Update your 2H forecast and extend through next year with bottom-up budgeting. Are there gaps between the bottom-up plan and your long-range plan. If you're optimizing your business, encourage other leaders in your organization to drive optimal outcomes through your company's investments. As an FP&A leader, you moderate the organization's needs between its leaders and investors to determine realistic goals.

Summarize and present your proposed targets to your board of directors. (Get their support--you need it.)

Complete your detailed planning when there are approximately three to four months left in your fiscal year. That's enough time to incorporate any feedback received from your board of directors.

As you finalize your detailed plan, ask: Where will our growth come from? How are we going to achieve it? Are we pursuing new channels, developing new products or contemplating new commercialization models? Are these included in your plan? Whether it's marketing, G&A or another function, plan holistically to align your metrics to drive business forward in leap functions versus linearly.

Update your commission and compensation plans to ensure the general philosophies support the ongoing business strategy. This aligns the corporate strategy, operational plans and the incentivization of your team members. Stronger strategic alignment creates stronger operational alignment. After you've established provisions, your FP&A (or often an Ops) team will assume responsibilities for detailed quota planning for the year.

In the final month of the year, update your forecast to validate against your budget. If nothing has materially changed since your presentation to the board of directors, proceed. If there are major changes to your business's trajectory or performance, make the adjustments before your next fiscal year starts.

Align your stakeholders by sending formal communication of the final budget to all budget holders. A CPM software allows every stakeholder works off the same plan and you've limited the possibility of misunderstandings.

It's time to celebrate--share your goals, operational plans and annual budget with the company.

Budgeting and forecasting never ends. Review and plan monthly, quarterly and annually to drive your business. Compare your actuals against your plan to drive an agile, ongoing approach to business planning.

Every organization approaches budgeting and forecasting differently, with the complexity and scope of your processes determined by your company's size, structure and industry. But budgeting and forecasting challenges can persist for any finance team--and the first step toward solving them is recognizing what those challenges are.

Here are some common challenges that might be holding back your budgeting and forecasting efforts:

According to the Vena Industry Benchmark Report, data silos are a challenge for 57% of finance teams. If you're spending too much time wrangling numbers from your ERP, CRM, HRIS and other data sources, you won't be able to analyze the story those numbers are telling you.

This slows down the budgeting and forecasting cycle and makes it harder to plan proactively when business conditions change. Data silos also make it difficult to collaborate with cross-functional stakeholders, leading to unreliable budgets and forecasts that don't capture a holistic view of your business.

Our latest Performance Management Survey revealed that 82% of finance teams still use offline Excel spreadsheets for budgeting, forecasting and other core FP&A activities. But the same poll also found that 54% of the Excel faithful aren't happy with their spreadsheet processes--saying they're too labour intensive, they take too long to complete and they're difficult to manage across the entire business.

It's clear that finance teams everywhere are comfortable and familiar with Excel. But once your organization reaches a certain level of maturity, offline spreadsheets won't have the processing power for advanced budgeting and forecasting. Using Excel alone to manage your budgets and forecasts can lead to version control issues, data integrity problems and formula errors from keying in numbers manually. Ever had a template crash when you're pushing towards a deadline? (Because that's what often happens when you treat Excel like a database.)

Budgets and forecasts have a lot of moving parts, which means keeping your contributors aligned is a pretty important job. But if you're searching your inbox for template files, chasing down colleagues for numbers and constantly losing sleep over whether your data is accurate, it's tough to keep track of your progress and maintain a healthy work-life balance--especially when you're spinning over "final" budget version 14.1-a.

That's why you need to have workflows, audit trails and data validation measures in place. Confident budgeting and forecasting is a whole lot harder without them.

According to this report from Deloitte, emerging technologies are reimagining the future of finance--and the teams that don't embrace this evolution risk falling behind the eight ball. For budgeting and forecasting in particular, a complete planning solution can help you get ahead by making your processes faster, easier and more reliable. Read on to find out how.

A complete planning solution leverages both relational and OLAP cube database structures so you can bring all your financial information into one source of truth in the cloud. By integrating directly with your ERP, CRM, HRIS and other source systems, you won't have to input numbers manually while building budgets or generating forecasts. Instead, the cells in your templates would be mapped right back to your data sources so the values just flow in automatically whenever you need to refresh them.

Here are some other benefits of automated data entries for budgeting and forecasting:

With all that time saved, you won't have to waste days wrangling data for budgets and forecasts. Instead, you'll be able to focus on what really matters: Planning for the future of your business.

According to a recent Pulse of Performance management survey, ease of use is the most important feature for a budgeting and forecasting solution to have. Automations certainly help with usability, but your software still won't get used if it's clunky and difficult to manage. In order to keep cross-functional stakeholders involved in your budgeting and forecasting processes, you need to choose a solution that's flexible and accessible for everyone.

Here's how a complete planning solution fits the bill:

If your business is always evolving, your budgets and forecasts are evolving too. However, if you don't have the ability to level-up your processes as you grow, you'll have a hard time adapting to the ever-changing needs of your organization.

A complete planning solution makes it easy to facilitate growth with a range of enterprise-grade features that complement budgeting and forecasting, such as:

Your budgeting and forecasting processes might not require all these features right away, but growing with a complete planning solution makes it easy to leverage them when you need to.

Request a Demo to see how Vena can support your budgeting & forecasting needs.

Schedule DemoEvan Webster is an experienced sales professional and storyteller with a passion for innovative technology. He currently serves as a Senior Area Sales Manager at Vena and previously worked as a Content Specialist. He continually strives to inspire finance professionals to become strategic business partners and is dedicated to helping them automate and streamline their planning processes so they can make better decisions with reliable, data-driven insights—enabling meaningful growth for organizations across the globe.