Strategy and Operations

Report: 55% of Businesses Operate With a 12-Month Rolling Bottom-Up Forecast and Budget Process

Bottom-up budgeting processes provide more visibility into both departmental goals and organizational goals.

All businesses engage in budgeting and forecasting activities to some degree—and if you're an executive, finance leader, or operations professional, improving these processes should always be a top priority.

Budgeting and forecasting help you formulate strategies, plan effectively for the future, and align goals across your entire organization. While budgeting involves planning your company’s revenues and expenses for a specific timeframe, forecasting leverages historical data to predict future business outcomes. Whether you use a manual budgeting process, or use AI for forecasting, both processes are critical components of a company's growth journey, especially during periods of change or uncertainty.

To better understand budgeting, forecasting, and how they contribute to organizational success, let’s explore their definitions, key differences, benefits, and practical ways to implement them effectively.

Budgeting is the structured process of planning your company's revenue and expenses for a defined period of time. It involves identifying available cash flows and allocating financial resources to cover required spending.

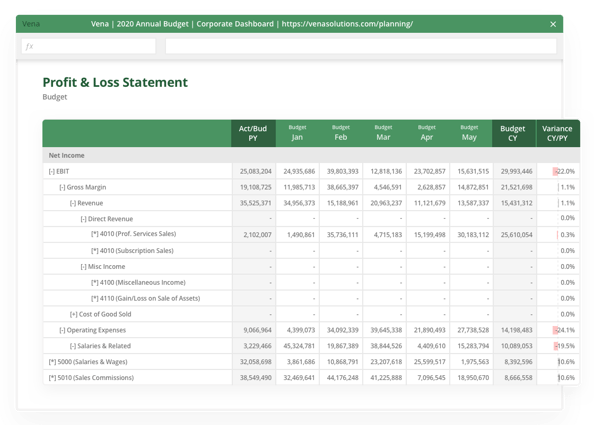

When complete, your budget typically includes detailed financial documents, such as the income statement, balance sheet, and cash flow statement, and provides measurement metrics that management can use to assess financial progress.

Budgeting enables your organization to strategically chart a clear financial path and guide decision-making processes effectively. Regardless of your budgeting method—incremental, zero-based, or activity-based—the resulting plan clearly reflects your company’s financial and operational objectives.

Additional budgeting benefits include:

However, because budgets are prepared so far in advance and based on a fixed set of assumptions, they can quickly become outdated as soon as those assumptions change.

When budgeting can't meet certain time-sensitive needs forecasting takes over.

Forecasting is the process of analyzing historical trends in order to predict future business results based on your company's most up-to-date actuals. Unlike budgeting, forecasting usually takes place over shorter, rolling periods—often monthly or quarterly. Forecasts typically focus on major revenue streams and expense categories.

![]()

When done efficiently and with reliable data, forecasting gives you the insight you need to reallocate resources proactively and help your managers make data-driven business decisions. There are plenty of other benefits to forecasting, including:

Budgeting and forecasting are complementary, but they're definitely not the same. Before we get into best practices and common challenges with budgeting and forecasting, let's break down the key differences between them.

We already know that budgeting is figuring out how much money your company will need to spend in order to achieve its desired business results. Forecasting, on the other hand, is about proactively analyzing the budget and using both historical and real-time data to predict what those business results will look like.

We already know that budgeting is figuring out how much money your company will need to spend in order to achieve its desired business results. Forecasting, on the other hand, is about proactively analyzing the budget and using both historical and real-time data to predict what those business results will look like.

| Aspect | Budgeting | Forecasting |

| Projected Timeframe | Usually covers 1-5 years | Period forecasts cover the current fiscal year; rolling forecasting typically looks forward to a slower timeframe |

| Preparation Time | 3-6 months | 1-4 weeks |

| External Disclosure | Not disclosed | Disclosed (required for public companies |

| Reliability | Less reliable later in the year when numbers are outdated | More reliable due to frequent updates and use of current data |

| Best Used For | Formulating high-level strategies and business goals | Making targeted, short-term data-driven decisions |

Think of it this way: Your budget is your road map, highlighting key financial checkpoints for every phase of the business journey. But once that journey has started, it's common for circumstances to change, ultimately outdating the original assumptions that were made when the budget was created.

For proactive finance teams, best practices involve regularly reviewing your budget against the changing business environment, forecasting accordingly to determine where the numbers are headed, then adapting your plans as required.

Just because companies need budgeting and forecasting, doesn’t mean that the process comes without challenges.

Every organization approaches budgeting and forecasting differently, with the complexity and scope of your processes determined by your company's size, structure and industry.

But budgeting and forecasting challenges can persist for any finance team--and the first step toward solving them is recognizing what those challenges are.

Here are some common challenges that might be holding back your budgeting and forecasting efforts:

According to the Vena Industry Benchmark Report, data silos are a challenge for 57% of finance teams. If you're spending too much time wrangling numbers from your ERP, CRM, HRIS and other data sources, you won't be able to analyze the story those numbers are telling you.

This slows down the budgeting and forecasting cycle and makes it harder to plan proactively when business conditions change. Data silos also make it difficult to collaborate with cross-functional stakeholders, leading to unreliable budgets and forecasts that don't capture a holistic view of your business.

Our latest Performance Management Survey revealed that 82% of finance teams still use offline Excel spreadsheets for budgeting, forecasting and other core FP&A activities. But the same poll also found that 54% of the Excel faithful aren't happy with their spreadsheet processes--saying they're too labour intensive, they take too long to complete and they're difficult to manage across the entire business.

It's clear that finance teams everywhere are comfortable and familiar with Excel. But once your organization reaches a certain level of maturity, offline spreadsheets won't have the processing power for advanced budgeting and forecasting.

Using Excel alone to manage your budgets and forecasts can lead to version control issues, data integrity problems and formula errors from keying in numbers manually. Ever had a template crash when you're pushing towards a deadline? (Because that's what often happens when you treat Excel like a database.)

Budgets and forecasts have a lot of moving parts, which means keeping your contributors aligned is a pretty important job. But if you're searching your inbox for template files, chasing down colleagues for numbers and constantly losing sleep over whether your data is accurate, it's tough to keep track of your progress and maintain a healthy work-life balance--especially when you're spinning over "final" budget version 14.1-a.

That's why you need to have workflows, audit trails and data validation measures in place. Confident budgeting and forecasting is a whole lot harder without them.

Budgeting and forecasting can become complex, resource-intensive processes—especially if your business relies heavily on manual methods like spreadsheets. Modern FP&A platforms simplify these processes, enabling finance teams to spend less time collecting data and more time delivering strategic insights.

With budgeting and forecasting software solutions, you can automate repetitive tasks, improve accuracy, and integrate real-time data from multiple sources. Technology eliminates common pain points, including manual data entry errors, version control issues, and disconnected workflows.

FP&A technology helps your team to:

By adopting technology to enhance budgeting and forecasting, finance teams are better equipped to anticipate market shifts, respond rapidly to business needs, and proactively support strategic decision-making—ultimately positioning your company for sustained, profitable growth.

Discover how Vena’s budgeting and forecasting software can take your planning cycle to the next level.

Request a Demo to see how Vena can support your budgeting & forecasting needs.

Schedule DemoEvan Webster is an experienced sales professional and storyteller with a passion for innovative technology. He currently serves as a Senior Area Sales Manager at Vena and previously worked as a Content Specialist. He continually strives to inspire finance professionals to become strategic business partners and is dedicated to helping them automate and streamline their planning processes so they can make better decisions with reliable, data-driven insights—enabling meaningful growth for organizations across the globe.