Simplicity cuts both ways. It can un-complicate things, which is particularly helpful when dealing with large data sets or financial figures. But, it can also create an illusion of non-complexity, which is dangerous when a problem is genuinely, well…complex.

That’s what makes the SaaS “magic number” a divisive metric among CFOs and finance executives.

The SaaS magic number, at its most basic level, helps software companies determine how much new revenue the business will generate as it spends more to acquire new customers.

Read on to learn more about the SaaS magic number, how to calculate and implement it, and why some SaaS leaders feel that it’s not as “magical” as it seems.

Key Takeaways

- The SaaS magic number measures sales efficiency, and is used by many SaaS companies.

- The magic number reveals how much new revenue may be expected as a SaaS company increases spending to acquire new customers.

- A magic number of 0.75 or above is considered to be good, or a sign that a company is operating efficiently.

- While a relatively simple metric, some experts believe the SaaS magic number may be misleading, as it equates correlation with causality, and fails to give a fully rounded picture of sales efficiency.

What Is the SaaS Magic Number?

The SaaS magic number is a ratio that looks at a company’s sales and marketing sustainability and determines how much recurring revenue can be generated as spending on sales and marketing increases.

The SaaS magic number was first developed in 2005 by Rory O’Driscoll, a Partner at Sale Venture Partners. O’Driscoll managed to calculate that a prospective investment target was able to double its revenue for every dollar it spent on customer acquisition—he deemed it “magic.” Thus, the term “magic number” was born.

The magic number itself is calculated by roping in several financial metrics, including how much a SaaS company spent on customer acquisition efforts (sales and marketing spend) during the previous quarter, and company revenues for the current and previous quarters.

How To Calculate SaaS Magic Number? [Formula and Examples]

Calculating the SaaS magic number isn’t a huge lift.

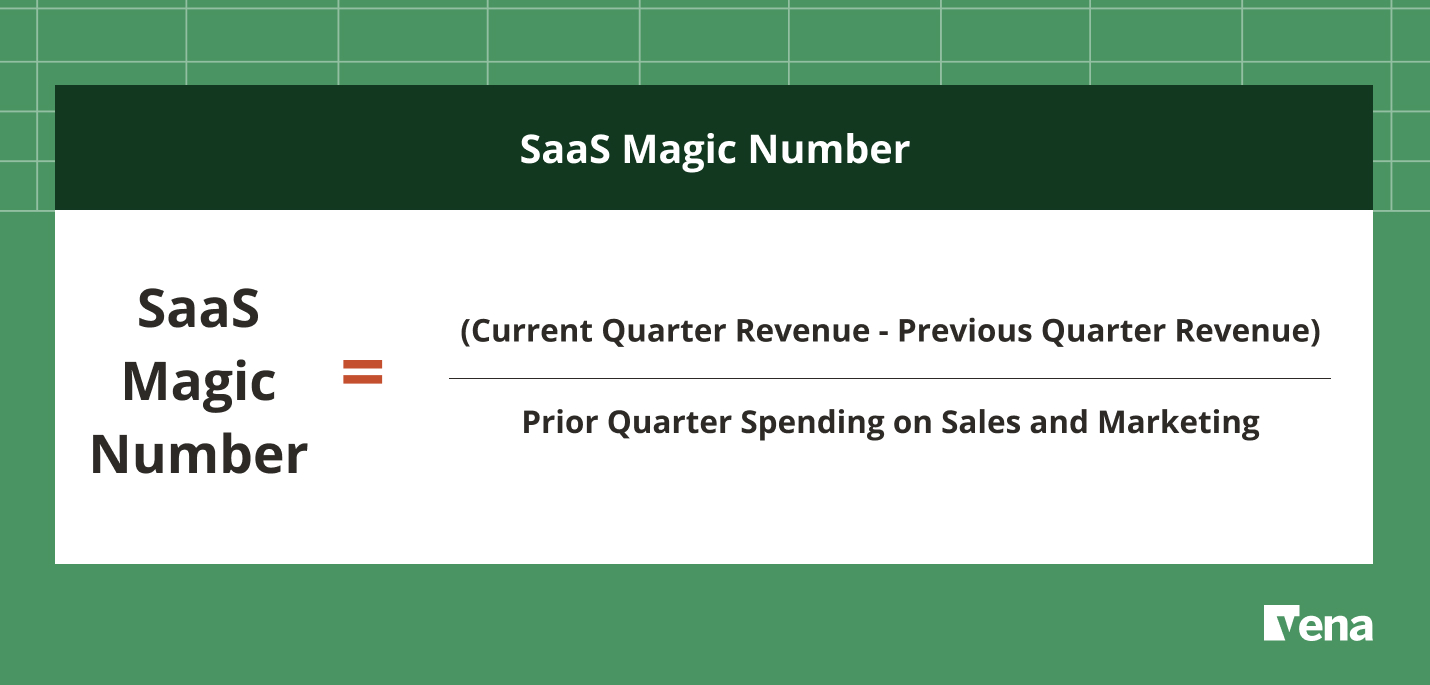

First, you’ll subtract revenue from the prior quarter from the current quarter’s revenue. Then, you’ll divide this by the prior quarter’s overall spending on sales and marketing.

Here’s what the SaaS magic number formula looks like:

What’s a “Good” Magic Number?

After calculating, a magic number of “1” means that customer acquisition spend is generating more new revenue than the costs themselves—or, that spending on sales and marketing is leading to more new revenue, paying for itself and then some.

In a general sense, a “good” magic number is more than 0.75. That's a good SaaS statistic, and a sign that the company’s sales and marketing efforts are operating efficiently. A magic number of 1 or above is a very strong signal that the company is firing on all cylinders. Conversely, a magic number of 0.5 or below tends to mean that a company’s customer acquisition costs are higher than the new revenue they’re generating, and could be taken as a worrisome sign.

To illustrate, we’ll run through a few examples of calculating the magic number for current public SaaS companies.

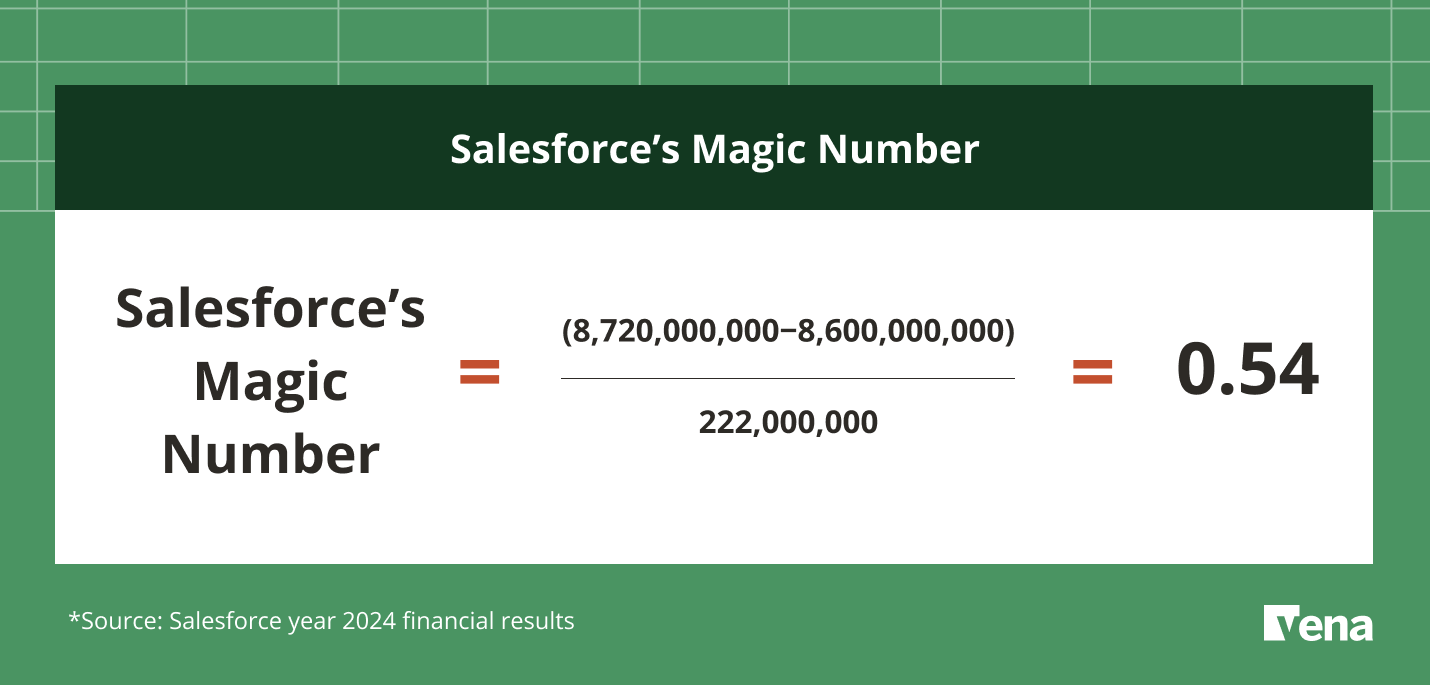

Magic Number Example 1: Salesforce

From Salesforce’s fiscal year 2024 financial results, we’ll calculate its magic number for Q3 FY 2024, which ended on October 31, 2023. From its filings, we can pull out the following variables:

- Current quarter revenue: $8.72 billion

- Prior quarter revenue: $8.6 billion

- Prior quarter spending on sales and marketing: $222 million

And slot them into the formula:

The resulting 0.54 is a relatively poor magic number, and a sign that Salesforce may need to find ways to improve its sales efficiency.

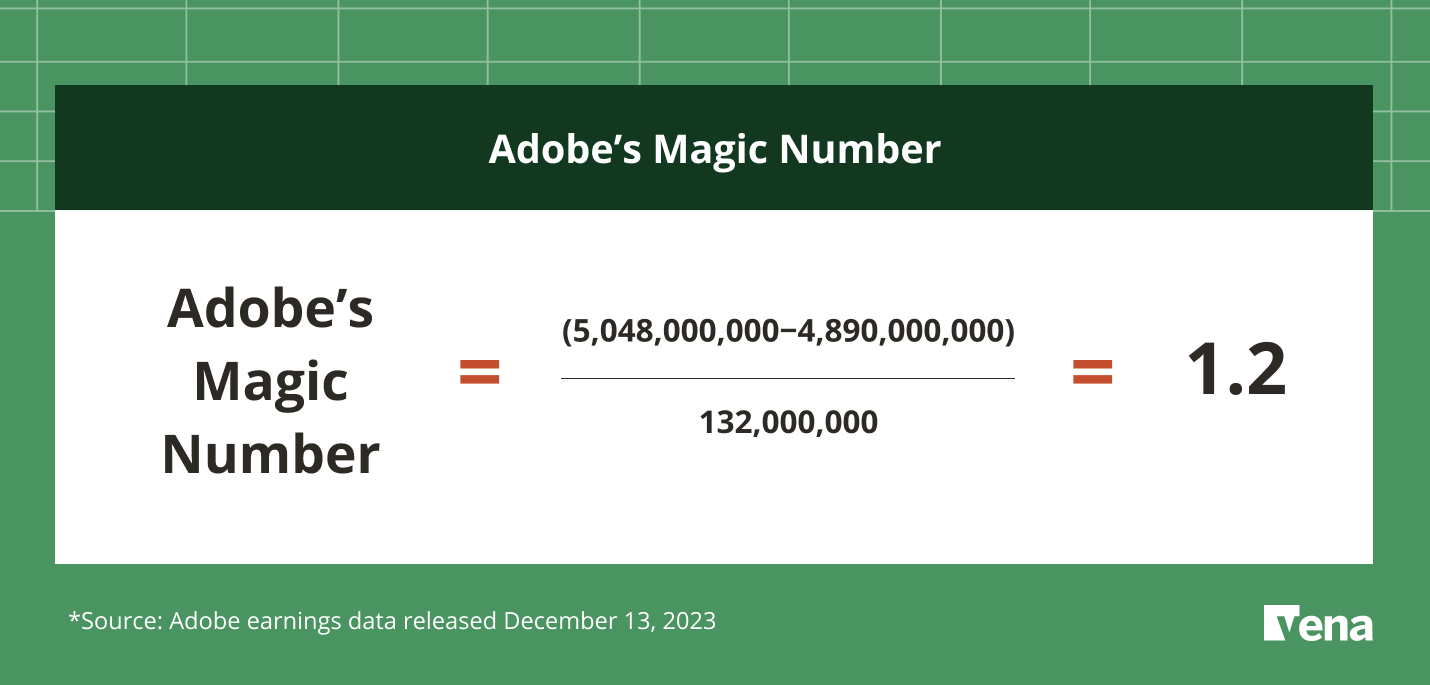

Magic Number Example 2: Adobe

Here’s another example, using Adobe’s latest earnings data, released on December 13, 2023. Looking at Q4 FY2023:

- Current quarter revenue: $5.048 billion

- Prior quarter revenue: $4.89 billion

- Prior quarter spending on sales and marketing: $132 million

Adobe’s resulting magic number of 1.2 is strong, and a sign that its sales and marketing efforts are generating more new revenue than they cost the company.

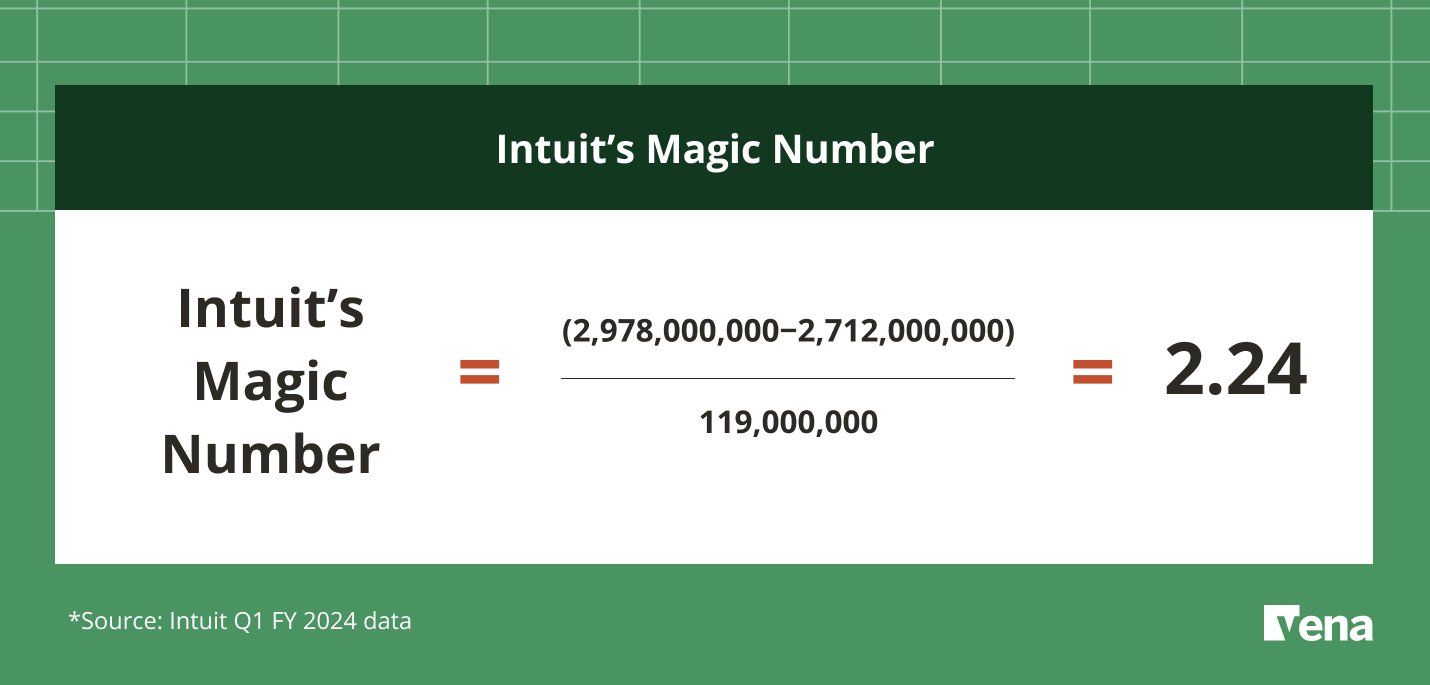

Magic Number Example 3: Intuit

And here’s a third example, using Intuit’s Q1 FY 2024 data, released on November 28, 2023:

- Current quarter revenue: $2.978 billion

- Prior quarter revenue: $2.712 billion

- Prior quarter spending on sales and marketing: $119 million

Intuit’s magic number is very strong—so strong that the company may be underinvesting in its customer acquisition efforts.

Limitations of the SaaS Magic Number

As we mentioned earlier, the magic number isn’t perfect, and a main criticism is that it paints with a broad brush—or, may oversimplify a complex business operation.

Nnamdi Iregbulem, a Partner at venture firm Lightspeed, wrote in a blog post that as a metric, the magic number “is so overused and confused at this point that it harms analysis more than it helps.”

He continued, writing that “My core beef with the metric is that it takes what is fundamentally a correlational relationship and confuses it with causality, to the chagrin of many strategic finance teams on the inside and investors attempting to model and forecast businesses from the outside.”

In other words, he believes that the magic number formula produces a number that overstates the actual effect of customer acquisition spending, and it may not be wise for SaaS companies to rely on it. It’s a bit more complex than it appears.

What’s more, CJ Gustafson, CFO at PartsTech, an auto parts software company, wrote in late 2023 that while the magic number “is one of the most compound of compound metrics,” it doesn’t show a complete mosaic.

He recommends using it in tandem with a slew of other metrics, such as CAC payback period, blended CAC ratio, net dollar retention rate and burn ratio, among others (you can read more about several of these metrics here).

All in all, the magic number isn’t magic—though it may feel like it in some respects.

It’s important to keep in mind that it’s merely one metric, and one that has its flaws. Accordingly, CFOs and finance leaders may do well to not rely upon it completely to gauge sales efficiency, but to include it as only one part of a larger set of metrics.

The Magic Number: Only One Spell at Your Disposal

The magic number can be helpful to SaaS executives and CFOs, but it’s only one potential “magic” spell at your disposal.

Vena makes it easier to stay on top of all the metrics that are important to your SaaS business—like customer lifetime value, revenue retention and churn—by allowing you to manage all your budgeting, planning and financial reporting processes in one place.

Vena’s powerful database technology integrates data from your ERP, CRM, HRIS and Payroll systems, so you can spend more time analyzing your numbers and less time collecting and verifying them.

And with Vena for SaaS, you’ll gain access to pre-built (yet customizable) templates, reports and dashboards that update automatically based on your real-time actuals.