Until recently, Software as a Service (SaaS) was rapidly expanding across the globe as new companies realize the novel ways they can scale their business with SaaS tools. The SaaS industry recently shifted to more of a holding position focused on sustainability rather than growth, considering the current economic climate that isn’t as hospitable to rapid growth.

Businesses are now more attentive to their SaaS spending, leading to longer evaluation cycles and greater efforts to consolidate their tech stacks. As a result, SaaS companies face greater challenges in their revenue and financial planning.

With the eye-opening growth of SaaS over the last decade, we’ll discover just why — and how much — the SaaS market is changing by looking at key benchmarks across markets and industries. We’ll also look at the toughest challenges facing SaaS companies today, as well as solutions to overcome them.

While North America currently dominates the SaaS market share of both companies and customers, the global market is projected to grow rapidly over the next decade.

.png?width=1431&height=1236&name=saas-market-growth%20(1).png)

1. The global SaaS market is projected to grow from $317.55 billion in 2024 to $1,228.87 billion by 2032.1

2. The North American SaaS market represented 48% of the global market share in 2023, at $131.18 billion.1

3. The revenue share for software (compared to services) accounts for more than 84% of the SaaS market.6

4. The U.S. has the largest SaaS market share among all countries, with over 17,000 companies.1

5. Microsoft is one of the largest SaaS companies in the world, with $2.3 trillion in market capitalization as of 2023.8

6. From 2024 to 2032, the expected compound annual growth rate (CAGR) for the global SaaS market is 18.4%.1

7. The Asia Pacific SaaS market is expected to be the fastest-growing region in the next decade, with a CAGR of 22%.9

8. Experts predict that, by 2028, more than 50% of enterprise businesses will rely on industry cloud platforms.5

9. A 2024 survey revealed that 60% of businesses are budgeting to spend more on software this year.2

10. End-user SaaS spending is projected to surpass $1 trillion by 2027 for all end-user public cloud spending.5

11. The median growth rate for public SaaS companies as of October 2024 is 30%, down from an overall median of 35% reported in 2023.10

12. Among equity-backed SaaS companies, the median growth rate as of October 2024 is 30%, while bootstrapped organizations report a 25% median growth rate.10

13. As of October 2024, B2B private SaaS companies with annual recurring revenue (ARR) of less than $1 million reported the highest median growth rate at 50%.10

14. The largest B2B private SaaS companies with ARR of over $20 million had the lowest median growth rate as of October 2024, at 25%.10

15. In a 2023 survey, the overall median growth rate for all private SaaS companies in the survey registered at 30%, down from 35% the previous year.10

16. SaaS companies focusing on vertical markets reported slightly higher growth (31%) compared to those targeting horizontal markets (28%).10

17. Worldwide end-user spending on public cloud services is expected to reach $723.4 billion in 2025, up from $595.7 billion in 2024.7

18. Through 2027, 90% of organizations are predicted to adopt a hybrid cloud approach, using a mix of on-site servers and cloud technology.7

19. In 2025, revenue in the SaaS market worldwide is projected to reach $390.50 billion.11

20. Worldwide SaaS revenue is expected to have an annual growth rate of 19.38% between 2025-2029, leading to a market volume of $793.10 billion by 2029.11

SaaS is the biggest expenditure for businesses’ cloud services. In light of slowed market growth, businesses are being prudent about adjusting pricing structures and managing SaaS spending.

SaaS tools are the largest spend area when it comes to businesses' cloud services and therefore an area many companies are looking to reduce. In light of this, SaaS providers will need to guard their revenue carefully.

Strategies for generating SaaS revenue are transforming. These statistics explore SaaS revenue for both public and private companies, with a close look at customer acquisition, market segmentation, and growth trajectories.

21. The European SaaS Market is projected to bring in $95.02 billion in revenue in 2025.12

22. Large enterprises that employ more than 1,000 people accounted for over 60% of global revenue in the SaaS market in 2022.6

23. Private cloud companies accounted for 43% of global SaaS revenue in 2022, the largest market share among SaaS market segments.6

24. Public SaaS companies have an average of 36,000 customers.13

25. Private SaaS companies' median net revenue retention rate is 100% for companies below $1 million in ARR and 104% for companies above $20 million in ARR.14

26. There are 1,566 software companies with valuations greater than $1 trillion.15

27. The median ARR per employee for private SaaS firms in 2024 was $125,000.16

28. Enterprise SaaS companies with more than $20 million ARR have the highest median ARR per employee at $186,661.16

29. SaaS companies with less than $1 million ARR have the lowest median ARR per employee at $50,091.16

30. The average spend per employee in the SaaS market globally is anticipated to reach $108.70 in 2025.11

SaaS pricing strategies are a critical battleground for customer acquisition and retention. By analyzing trends in transparency, discounts, and the rise of value-based models, we get a glimpse into how SaaS businesses are balancing customer needs with their own revenue goals and KPIs.

31. A survey from OpenView Venture Capital found that 39% of SaaS organizations utilize a value-based pricing model to take advantage of the solution flexibility SaaS offers. Meanwhile, 24% copy their competitors’ prices.17

32. There is almost an even split between companies that choose to publish their pricing structure (45%) vs. those that do not (55%).17

33. 68% of surveyed SaaS companies discount their prices in fewer than one-quarter of all deals, and 29% admit to “very little discounting” from their sales teams.17

34. Between August 2022 and August 2023, 73% of SaaS providers raised prices by 12% on average.18

35. In Q4 2023, new software purchases accounted for 11% of total SaaS spend and was projected to fall to 8% by the end of Q1 2024.18

At one time, SaaS was considered a novel way to save money in the IT department. Now companies are realizing that SaaS can change their entire workflow, doing much more than just saving them money. At the same time, the number of SaaS providers grew significantly.

Naturally, there’s overlap between some SaaS applications. While companies are adopting new technologies, they’re also looking to cut redundancies and reevaluate their SaaS spending across the board, given the current economic environment.

Churn is a key SaaS KPI because even though companies often ask for the reasoning behind a customer leaving, churn is still especially hard to predict. Reducing churn can be tough without knowing where it comes from.

Let’s examine some statistics around SaaS adoption and SaaS churn rates.

36. SaaS purchases are overseen by a team of five people, on average, and 44% say their finance team is a part of the process most of the time.2

37. SaaS companies are often significant adopters of software products themselves—nearly 90% of IT professionals say automation is key, with 64% reporting it significantly reduces manual work.4

38. The average annual churn rate for SaaS companies is between 5-7%.19

39. Companies now use an average of 220 SaaS apps in 2024, down from 371 apps in 2023.21

39. The growth rate of SaaS apps slowed slightly in 2022, as 40% of IT professionals combined redundant applications.4

40. 53% of organizations reported that they consolidated redundant SaaS apps in 2024, up 40% from the year before.4

41. Three out of four IT professionals surveyed say they want SaaS solutions capable of insights-driven automation.4

42. 80% of businesses worldwide adopted Microsoft Azure's public cloud services in 2024, up from 73% in 2023.22

The perspective on SaaS adoption has evolved as companies have begun to realize that the benefits go far beyond just cost savings. As organizations continue to shift toward cloud-based solutions, their views on SaaS and its role in their operations are also changing.

43. The percentage of shadow IT, or the use of unauthorized software or devices, dropped from 53% to 48% from 2022 to 2023, indicating that organizations are taking more control over their SaaS usage and improving governance practices.4

44. Operations teams have seen the biggest increase in SaaS apps, growing their portfolio from 74 to 87, though their growth rate was lower than IT, Sales, and Product teams.21

45. Customer success teams showed the lowest growth rate for SaaS adoption at 5%, with an average of 61 apps.21

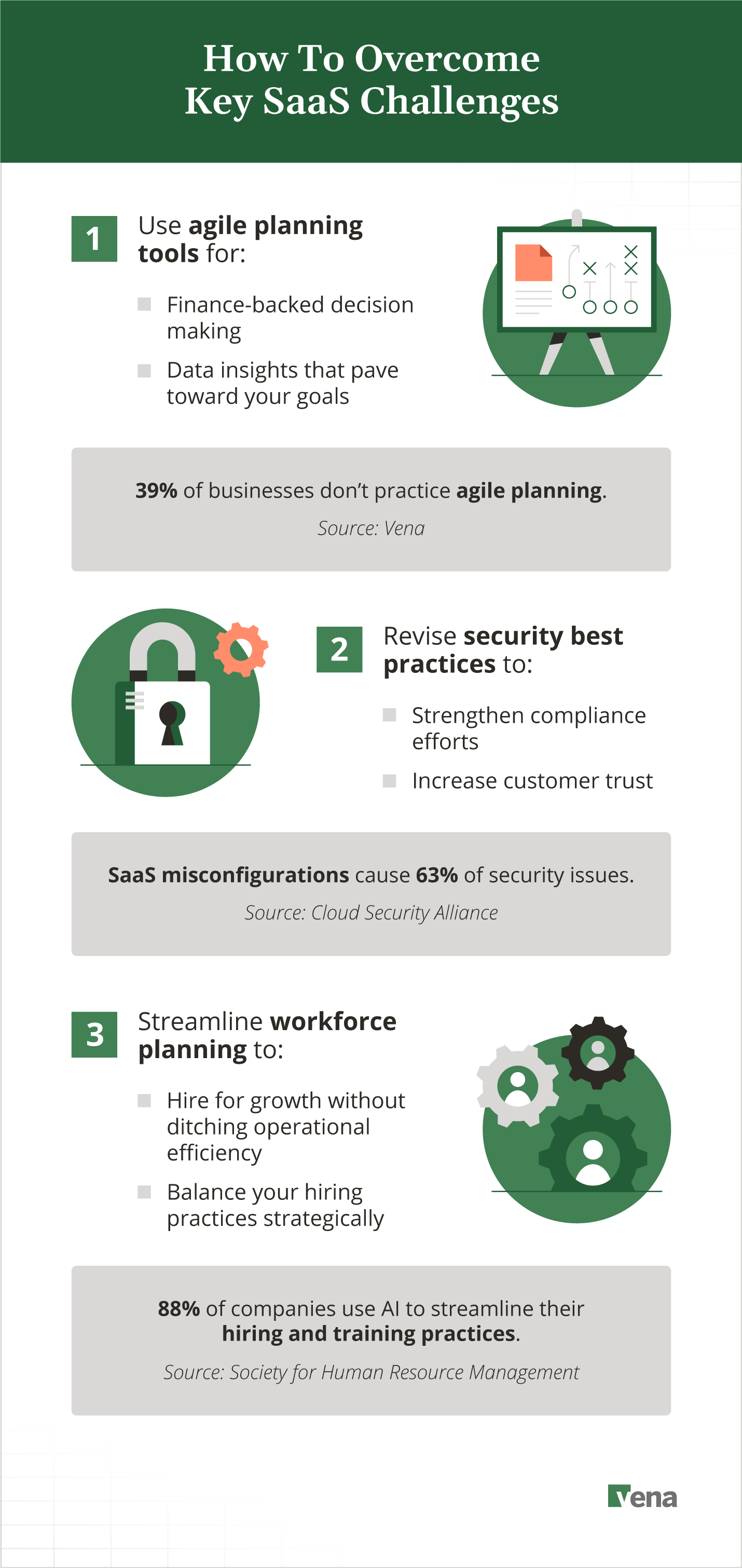

SaaS businesses face significant and often shifting challenges, like the unpredictable nature of venture capital funding. Company and user security, workforce management, and revenue planning are three primary pain points in the SaaS world.

Let’s break down each pain point and see what potential solutions SaaS companies can take to mitigate these challenges.

With costs and economic projections constantly changing, companies face steep challenges in planning revenue allotment for the future. And company by company, costs associated with R&D, selling, marketing, customer support, and general administration always fluctuate.

SaaS predominantly works on recurring revenue, making it easier to predict revenue in the short term. However, the uncertainty of whether customers will renew their contracts brings challenges.

Let’s review some important statistics about how SaaS companies making revenue decisions:

46. Venture capital funding for tech startups increased 21% year over year from 2023 to 2024, totaling $184 billion.23

47. Businesses surveyed find financial data is more than 3x more influential than customer data in influencing decisions, which included SaaS companies.3

48. Sales data only has half the influence of financial data in decision-making according to businesses that Vena surveyed, of which 13% were SaaS firms.3

49. In a 2022 survey of business leaders and finance professionals across industries including SaaS, 39% said their businesses don’t practice agile planning to prepare for the future.3

50. 41% of respondents, including those from SaaS businesses and firms in other industries, said they weren’t drawing on organizational data to influence decision-making, and even more disregarded sales, employee, and customer data for the same purposes.3

51. 55% of survey respondents, including SaaS businesses as well as other companies, said their organizations don’t adjust forecasts based on updated information.3

52. 60% of respondents noted that finance decision-makers don’t have a seat at the table for strategic planning discussions, and only 28% said they have the final say in those decisions.3

53. In a 2023 survey, 5.3% of SaaS companies reported flat or negative growth, up from 3.1% in 2022, highlighting a growing challenge for SaaS companies to sustain growth.10

54. SaaS spend per employee now averages $5,607, a 7% increase from 2023, reflecting the growing investment in technology and workforce.21

55. The median spend of ARR on research and development costs is 18%, down from 24% in 2023.24

56. The median percent spent on general and administrative costs is 11%, down from 15% in 2023.24

57. Equity-backed SaaS companies spend 90% more on sales, 82% more on general and administrative costs, 58% more on marketing and R&D, and 18% more on customer success than bootstrapped companies.24

Despite the challenges with revenue planning, there are concrete solutions that businesses can embrace to create better forecasts and budgets:

SaaS companies manage sensitive data in almost every application. This makes them targets for nefarious actors who want to damage or steal that information.

A lack of knowledge and resources about using SaaS software often leads to problems like SaaS misconfigurations that lead to vulnerabilities. Those vulnerabilities can lead to potential reputational damage for SaaS firms stemming from mishandled security incidents.

As these risks grow, the CFO's role in privacy and security is becoming increasingly important in guiding organizations to build stronger security practices.

Here are the top SaaS security statistics shaping how companies think about software safety.

58. 73% of organizations find achieving visibility into security risks in business-critical SaaS apps to be the most difficult aspect of managing SaaS security.25

59. Dedicated teams or staff focused on SaaS security are now present in 70% of organizations.25

60. In the past year, 39% of responding organizations have increased their SaaS security budgets.25

61. SaaS misconfigurations cause as many as 65% of organizational security problems.25

62. 46% of organizations surveyed only have the bandwidth for monthly or more infrequent checks for SaaS misconfigurations, and 5% never check for them.25

63. Geopolitical issues are expected to lead to an increase in defaults of SaaS contract commitments, directly affecting over 50% of subscribers.26

64. In the last year, 33% of IT professionals surveyed implemented a SaaS app that stores sensitive information.4

65. 45% of IT professionals surveyed have trouble securing SaaS user activities.4

66. In a 2024 survey, 69% of respondents reported that shadow IT was a top SaaS concern.20

67. Former employees from 31% of companies have accessed company assets stored in SaaS applications after they have left the company.27

68. Insider threats where former employees still have access to SaaS apps account for 22% of security problems.28

69. 38% of businesses face security concerns when planning investments in new software.2

70. Offboarding and de-provisioning ex-employees is considered a top security concern by 59% of executives at SaaS companies.20

How can SaaS businesses protect their brand's reputation and mitigate financial risk by maintaining strong security practices?

Consider these priorities to strengthen your SaaS security and best practices:

One of the biggest struggles SaaS companies encounter is workforce planning. Staffing is a large spend for SaaS companies, but this comes with its own challenges. The challenges start to rear their ugly heads when you take into account the 151,358 tech layoffs that occurred in 2024 across 542 companies.

Companies worry about hiring the right balance of employees as well as straddling the line between hiring for growth and prioritizing operational efficiencies. How do you tackle this challenge when the workplace is only getting more adaptive to new technologies, not less?

There are a few ways companies can streamline workforce planning and management to meet this task:

Since the early days of Salesforce’s first CRM in 1999, the SaaS industry has continued to evolve and transform the way businesses run. Now, cutting-edge advancements lead the way as priorities shift to creating seamless connections and adapting to a mobile-first world.

Recent news has shown a surge in investments in AI ventures, projected growth for AI-powered features, and the exciting potential of AI to streamline processes and ensure compliance.

71. ChatGPT has claimed the #1 spot in the shadow IT chart, as interest in AI applications and features continues to increase.21

72. The global Artificial Intelligence Software market reached $16.98 billion in 2024 and is projected to reach $80.6 billion in 2031, with a CAGR of 29.64%.29

73. Private investments in AI ventures are anticipated to grow to $200 billion globally and $100 billion in the U.S. by 2025.30

74. Revenue from AI data services for Machine Learning Operations tools is projected to almost quadruple between 2024 and 2028.31

75. Experts predict that, by 2028, generative AI will lead to a 30% drop in the risk of noncompliance in software and cloud contracts.26

76. By 2026, more than 80% of companies are expected to have deployed AI-enabled apps in their IT environments, up from just 5% in 2023.39

77. The global AI Created SaaS market is estimated to reach $770.32 billion by 2031, growing at a CAGR of 40.2% from 2024 to 2031.40

Ease of integration is one of the top priorities for B2B software buyers when evaluating tools.

In today's software landscape, seamless connections are critical to building a successful business. SaaS integrations have climbed the priority list for both software providers and their customers, but some obstacles remain.

78. More than 4 out of 5 tech companies cite integrations are “very important” or a “key requirement” for their customers.32

79. Global buyers rank integrations as #3 on their list of priorities when evaluating new software, behind security (#1) and ease of use (#2).33

80. 39% of buyers identified integration with currently owned software as the most important factor when choosing a software provider.33

81. Two out of five B2B professionals feel that integrating a new CRM into their existing systems is a major roadblock to implementation.34

Mobile devices dominate the tech landscape, both at the B2C and B2B levels. Ensuring your SaaS company’s offerings are optimized for mobile is a necessity for obtaining and maintaining customers.

82. By the end of Q4 2023, mobile devices accounted for 58.67% of the world’s website traffic.35

83. Many countries experience a significant percentage of web traffic coming through mobile, such as Nigeria at 86.67% and Vietnam at 86.51%. In comparison, the U.K. comes in at 48.71% and the U.S. at 44.25%.36

84. A one-second delay in page load time among mobile session traffic can result in a 26% drop in conversions.37

85. 50.48% of conversions occur through mobile devices, while 49.52% still rely on desktop.38

Even in a down market, the future is bigger and brighter for companies that can realize the full insights from their data.

Comprehensive and collaborative FP&A software like Vena can help your SaaS business accurately forecast revenue and monitor key metrics such as new logo, churn, CAC and LTV, helping you make more informed, efficient, and effective decisions.

Jumpstart the financial planning processes that matter most to your SaaS business with these eight templates.

Read Now